New focus reshapes 2023 Investment themes

|

Recession to top biggest market fear; balance sheet reduction to curb market liquidity

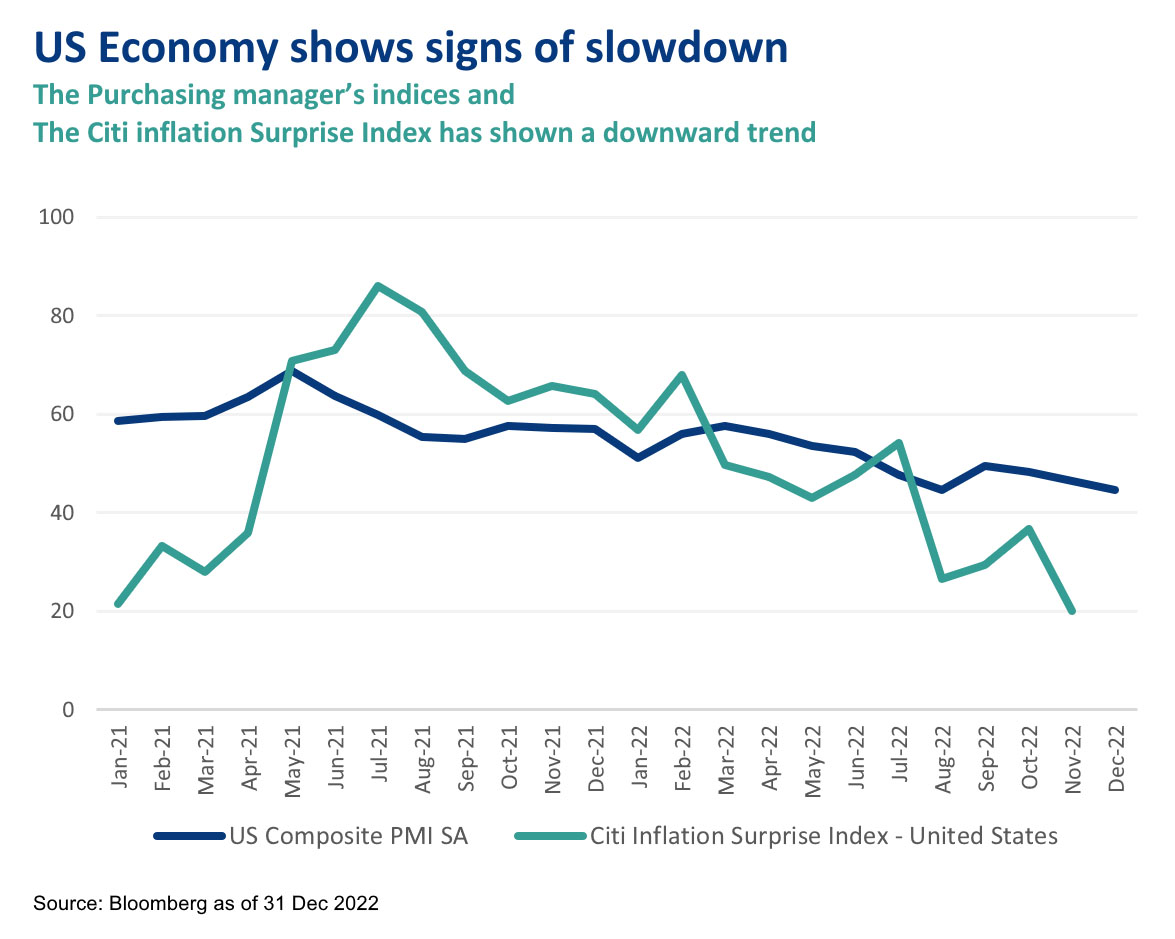

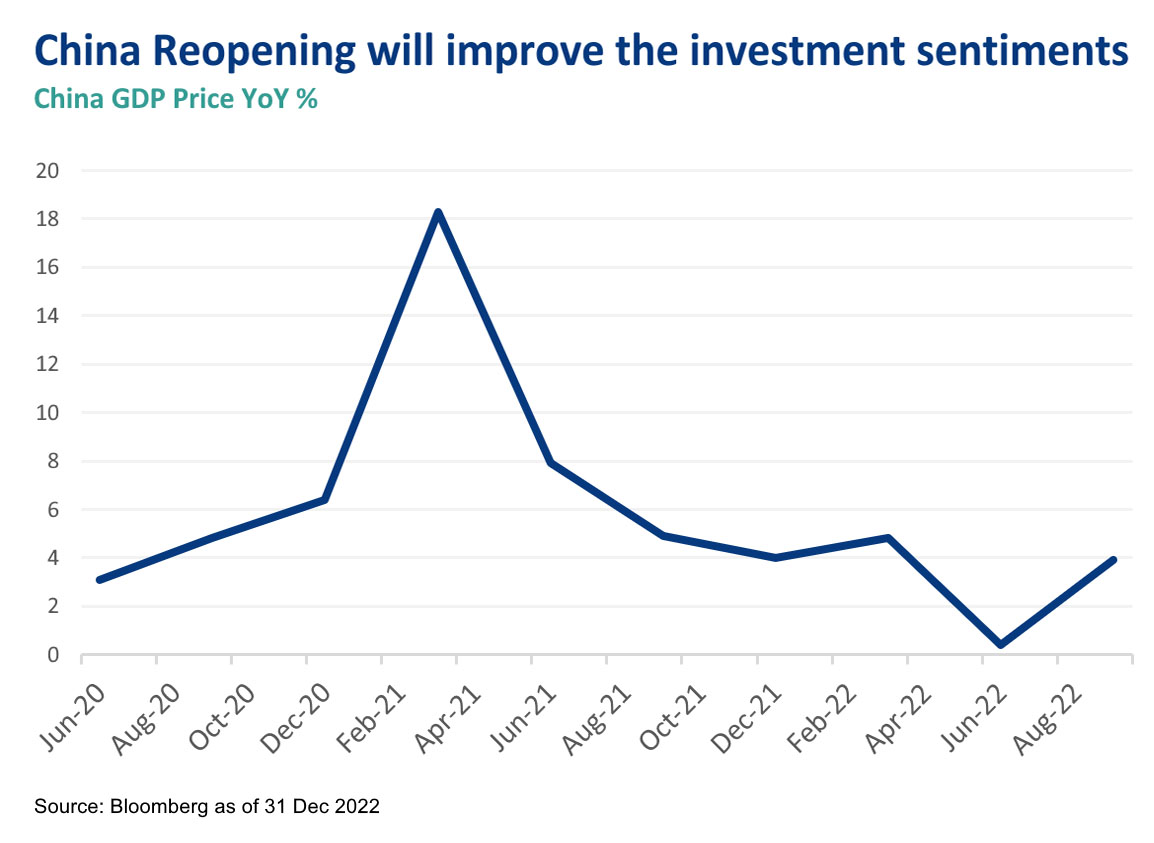

BEA Union Investment believes 2023 will be another challenging year. Patience is needed to scrutinize how specific key parameters turn out in the first half before deciding on future strategies. But for major overarching trends, the tones have been set, and these are the ones we have identified: First, while global inflation still remains structurally high, we should not be far from its peak. Second, recession fears will replace inflation worries to top market focus. Market has fully priced in rate hike expectations. What's left is the domino effect brought on by the impact of higher rates. BEA Union Investment believes recession in the US and Europe deemed inevitable, but the severity will vary to different extents. Third, monetary policy of major countries will remain reasonably tight. Fourth, as rate hike slows, central banks will shift their focus to trimming balance sheets from taming inflation, reducing liquidity in capital and credit markets. Market structure could turn vulnerable but should be manageable. Fifth, China's relaxation of its pandemic curbs and its broad-based supportive property package will boost sentiment, giving Asian and global economies a shot in the arm.

BEA Union Investment believes 2023 will be another challenging year. Patience is needed to scrutinize how specific key parameters turn out in the first half before deciding on future strategies. But for major overarching trends, the tones have been set, and these are the ones we have identified: First, while global inflation still remains structurally high, we should not be far from its peak. Second, recession fears will replace inflation worries to top market focus. Market has fully priced in rate hike expectations. What's left is the domino effect brought on by the impact of higher rates. BEA Union Investment believes recession in the US and Europe deemed inevitable, but the severity will vary to different extents. Third, monetary policy of major countries will remain reasonably tight. Fourth, as rate hike slows, central banks will shift their focus to trimming balance sheets from taming inflation, reducing liquidity in capital and credit markets. Market structure could turn vulnerable but should be manageable. Fifth, China's relaxation of its pandemic curbs and its broad-based supportive property package will boost sentiment, giving Asian and global economies a shot in the arm.

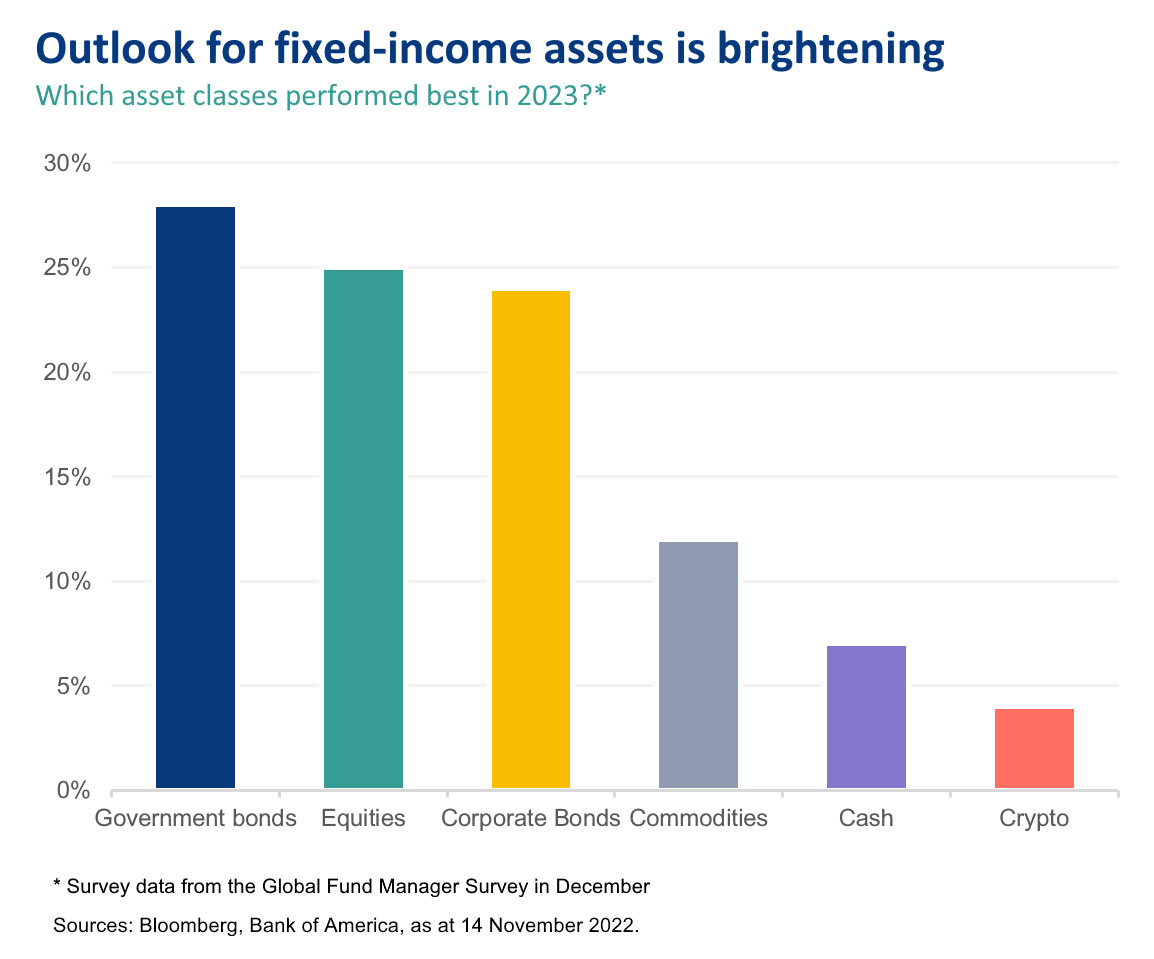

All in all, based on the aforementioned five factors, BEA Union Investment believes conditions for risk assets look set to improve next year, which could prompt a return of interest into fixed income assets. But the tide for equities may only take a visible turn towards the latter half. With economic outlook remained murky, some third-quarter corporate earnings showed weaker profitability, a sign that global growth could slow next year.

Moving in tandem with the end of the rate hike cycle is the USD one-way strength. The greenback's extraordinary rise to multi-decade high is drawing to a close as the pace of US rate hikes to ease and interest-rate volatility subsides. This paves way for Asian currencies to trade according to their own fundamentals. A narrowing rate spread and China's economic optimism could benefit the Renminbi, but gains could be capped by higher imports and travel outflows.

Softening greenbacks together with converging monetary policies across global central banks will bode well for non-USD international equity markets, such as Europe and Asia - China included, which are trading at cheap valuations. Our investment teams are optimistic on Asia, particularly ASEAN.

Bond market largely priced in negative factors; Asian credits to regain momentum

Price slump has boosted the appeal of fixed income, where prices are trading at attractive levels. The bond market has already priced in the challenging mix of inflation, rising interest rates and recession risk. Yields are near their cyclical peak and any further increases will likely be modest as the US will unlikely raise rates substantially next year. BEA Union Investment believes opportunities are emerging in both investment-grade and high-yield bonds.

Considering the probability of a recession next year and the unknown of when rate hike will come to a close, investment-grade papers serve as a partial buffer against any further interest-rate rises and price falls. The asset class also enjoys relatively limited risks and stable fundamentals. If the recession turns out to be more severe than expected, high-yield papers will face greater pressure as the asset class is more susceptible to spread widening. But they are not without opportunities. If examines closely, there exists high yield papers that offer attractive yields with decent fundamentals. In face of a recession next year, liquidity could subsequently tighten. It is pertinent to evaluate the issuers' balances sheets, whether they face financing pressures and how well they can withstand the looming recession.

In terms of regions, in face of limited upside in US treasuries yields, our investment teams believe interest in Asian bonds would rekindled. Furthermore, mounting demand from China could offset the adverse impact on Asian exports brought upon by slower growth in the US and Europe. Outbound travelers from China and rising consumer demand will provide a boon to countries such as South Korea and Thailand. As such, BEA Union Investment believes fund flows could return to risk assets, supporting Asian bonds.

Chinese bonds and equities regain momentum on supportive covid, property measures

Since the wrapping up of the 20th National Congress, policies in China underwent significant changes. Sentiment took a U-turn after the government lifted its stringent pandemic curbs and launched a raft of measures to rescue the lacklustre property market. BEA Union Investment has turned more positive towards Chinese equities and bonds, including reopening theme stocks as well as property, industrial and Macau gaming bonds.

Since the wrapping up of the 20th National Congress, policies in China underwent significant changes. Sentiment took a U-turn after the government lifted its stringent pandemic curbs and launched a raft of measures to rescue the lacklustre property market. BEA Union Investment has turned more positive towards Chinese equities and bonds, including reopening theme stocks as well as property, industrial and Macau gaming bonds.

To salvage developers who had been beleaguered by weak sales and incomplete housing projects, China subsequently rolled out a "three arrows" package and the "16-point plan". Through credit, loans and equities refinancing, state-owned banks pledged funding to developers, local bond sales with state guarantees are facilitated while listed-developers can resume selling stocks for refinancing. Encouraged by the government's broad-based package, our investment teams grew more confident towards the outlook of mainland property bonds. Buoyed by policies and attractive valuations, we grew positive towards high-yield property papers. We also favour BBB-rated China asset management companies (AMC) and telecoms, media and technology (TMT).

Our views towards Macau gaming also turned more constructive on hopes that the city could see an increase in travelers and more casino visitors after China eased its mobility restrictions. Casino licenses have been granted, removing a long-awaited market overhang. As for Hong Kong government bonds, we are still fond of them for their resilient fundamentals and attractive yields.

China's easing of its pandemic requirements also contributed to our positive views towards Chinese and Asian equities, especially in developers and internet stocks. We also look set to increase exposure in internet hardware, pinning hopes that the sector will see some meaningful recovery in the second half of 2023. Favourable policies will also boost the appeal of Asian equities, including consumer staples, technology communications and healthcare.

Apart from cyclical strategy, in terms of long-term opportunities, decarbonization coupled with China's evolving demographics will drive the growth in secular sectors, such as green technologies and healthcare. These are spaces we favour given both present secular opportunities and supported by favourable government policies. Chinese companies have dominating positions in various green technologies, such as the production of solar panels and lithium-ion batteries for electric cars. The growth prospects in these sectors are not to be overlooked.

Insatiable demand boosts appeal for Indonesian, Indian and Australian energy equities and bonds

Geopolitical tensions sent commodities prices higher, bringing challenges to decarbonization targets and fueling inflationary pressure. But these set the stage for rosier prospects for Asian equities and bonds. China unwound its pandemic policies also buoyed the prospects of greater demand for commodities.

Geopolitical tensions sent commodities prices higher, bringing challenges to decarbonization targets and fueling inflationary pressure. But these set the stage for rosier prospects for Asian equities and bonds. China unwound its pandemic policies also buoyed the prospects of greater demand for commodities.

Indonesia, a major energy and commodities exporter of palm oil, coal, gas and copper ore, has been on a stronger footing as its global peers are struggling with a plethora of economic challenges. Steep commodities prices supported the economy and exports, raising expectations for a current account surplus. Russia-Ukraine conflict continued to disrupt energy supplies, sending LNG prices higher that help energy producers to generate substantial windfall profits and cashflow. Thanks to relatively lower US treasury yield, and the country's resilient fundamentals, we believe Indonesia's investment-grade state-owned energy bonds should fare well.

Another area that we favour is India's renewable high yield space, which is a sizeable sector with a defensive nature. Being the world's third-largest consumer of electricity and renewable producer, by 2030, India aimed to cut total projected carbon emission by 1 billion tonnes, reduce the carbon intensity of the nation’s economy by less than 45%, and expand its renewable energy installed capacity to 500 GW. Low-carbon technologies could create a market worth up to $80 billion in India by 2030, according to market estimates. Favourable government policies will be needed to support companies in the renewable sectors to finance these projects. We believe the fundamentals will be strengthened and stayed attractive as a result.

The production of green technologies require the use of critical minerals, which will spur economic growth of industrialized nations such as Australia, which is home to many minerals critical for the electrification of transportation and other green applications. Inventories of metals, such as aluminum, copper, nickel and zinc, have declined to supportive levels even though temporary weakness of the Chinese economy is impacting demand. Our investment teams expect the appeal with industrialised countries will increase as the transition to green energy drives demand for various industrial metals, which are in short supply.

Australia, a key LNG exporter alongside Qatar and the US, posted in October a record revenue of US$7 billion from the export of LNG. Apart from Asian countries, Germany has recently joined the importer list of Australian LNG, as part of a bid to solve the issue of energy shortage. These factors support our investment thesis towards Australian energy stocks.

Summary

2023 would be another challenging year. Are rate hikes and balance sheet reduction effective tools in taming inflation? How hard a blow will monetary tightening take on global economies? These are questions that are yet to be answered. But a global downturn cushioned by China's reopening optimism, coupled with a softening greenback should brighten the outlook for Asian bonds and equities.