Please scroll down to read through the Important Information for Investors. Please click the "ACCEPT" button below to acknowledge that you have read and understood the information and agree to abide by its contents, otherwise click "EXIT" to leave the website.

Umbrella Funds managed by BEA Union Investment Management Limited

-

“BEA Union Investment Series” is an umbrella unit trust established under the laws of Hong Kong.

-

“BEA Union Investment Capital Growth Fund” is an umbrella unit trust (also an approved pooled investment fund) established under the laws of Hong Kong.

-

“BU Fund Series OFC” is a public open-ended fund company regulated under the laws of Hong Kong (business registration number 71817286) with variable capital and limited liability and segregated liability between sub-funds.*

-

“BU Investment Series OFC” is a public open-ended fund company regulated under the laws of Hong Kong (business registration number 72687438) with variable capital and limited liability and segregated liability between sub-funds.*

*Registered with the Securities & Futures Commission under the Securities & Futures Ordinance of Hong Kong with registered office at 5/F, The Bank of East Asia Building, 10 Des Voeux Road Central, Hong Kong

Information Applicable to the Umbrella Funds Managed by BEA Union Investment Management Limited

-

Each umbrella fund has within it different sub-funds investing in equities and/or bonds, each with a different risk profile.

-

A sub-fund’s investment portfolio may fall in value, and therefore investor’s investment in the sub-fund may suffer losses. There is no guarantee of the repayment of principal.

-

A sub-fund may be subject to general investment and market risks, custody risks, settlement risks, equity investment risks, regulatory risk of equity markets, volatility risk, risk associated with small-capitalisation/mid-capitalisation companies; and risk of investing in IPO.

-

A sub-fund that invests in debt securities is subject to interest rate, credit/ counterparty, downgrading, below investment grade & non-rated securities risk, volatility and liquidity, sovereign debt, valuation and credit rating risks.

-

A sub-fund may be subject to risks associated with debt instruments with loss-absorption features, dim-sum bond market risks, risks associated with China Interbank Bond Market and Bond Connect, risks of investing in urban investment bonds.

-

A sub-fund that invests in China A Shares (via Qualified Investors “QI”, Stock Connects or other permissible schemes available from time to time) may be subject to QI risk, risks associated with Stock Connects, and risks associated with the ChiNext Market and Science and Technology Innovation Board.

-

Sub-fund that invests in certain Mainland China securities may be subject to withholding and other taxes imposed in Mainland China, and thus expose to Mainland China tax risk.

-

A sub-fund may be subject to concentration risk /China and Asia market risk, emerging markets risk, asset allocation risk, risks of investing in other funds, currency risk, currency hedging risk, RMB currency and conversion risks.

-

A sub-fund may use derivatives instruments for hedging and/or investment purposes. The leverage element of a derivative instrument or the ineffectiveness in achieving hedging can result in a significant loss.

-

The Manager or Directors (as the case maybe) may at its discretion make distribution from income and/or capital in respect of the distributing classes of a sub-fund. Distributions paid out of the capital amount to a return or withdrawal of part of the investors’ original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per unit (or share). “Net distributable income” means the net investment income (i.e. dividend income and interest income net of fees and expenses) attributable to the relevant distributing class and may also include net realised gains (if any) based on unaudited management accounts. However, “net distributable income” does not include net unrealised gains. Distribution is not guaranteed. Past distribution record is not an indicative of future distribution. A positive distribution yield does not imply a positive return.

Investors should not make an investment decision based solely on this website.

Investors should read the relevant Hong Kong offering documents carefully before making any investment decisions. If you are in any doubt about the contents of any

Hong Kong offering documents or this website, you should seek independent professional advice.

Terms of Use

You must carefully read the following terms of use (“Terms of Use”) of this website and any pages thereof (“this website”) before proceeding. By accessing this website, you acknowledge that you have read the Terms of Use and you have accepted and agreed to be bound by the Terms of Use. If you do not agree to the Terms of Use, do not access this website.

BEA Union Investment Management Limited (“BEA Union Investment”) reserves the right to amend the Terms of Use at any time without notice. If you use this website after the amended Terms of Use has been published, you will be deemed to have agreed to the Terms of Use, as amended.

This website is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this website is prohibited or is in contravention with the applicable laws, regulations or rules. You should proceed into this site only if you have satisfied yourself that the country in which you are based imposes no prohibitions or restrictions on the distribution of the collective investment schemes (“funds”) on this website. This website is not intended for persons who are residents in any country/place where the funds are not registered or approved for marketing and for sale, or in which the dissemination of fund information is not permitted. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

Unauthorised use of this website, including without limitation unauthorised entry into BEA Union Investment’s systems, misuse of other information is strictly prohibited. You may not use this website in any manner that could damage, disable or impair this website or interfere with any other party’s use of this website. You may not attempt to gain unauthorised access to any BEA Union Investment’s website or service, computer systems or networks through hacking, or any other means. You agree that you will not engage in any activities related to this website that are contrary to applicable laws or regulations.

Additional Terms

Certain sections or pages on this website may contain separate terms and conditions, which are in addition to these Terms of Use. In the event of a conflict, the additional terms and conditions will govern for those sections or pages.

Issuer of Website

The information contained herein is issued by BEA Union Investment. This website has not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong.

General

This website has been prepared by BEA Union Investment for information purposes only. Information contained in this website is current as at the date of issue. BEA Union Investment has the right to delete or modify information on this website without prior notice. There is no guarantee that the information on this website has not been altered as a result of technical malfunctions (disconnection, interference by third parties, computer viruses, etc.).

BEA Union Investment reserves the right to grant or revoke the authority to use this website at its absolute discretion. Whilst BEA Union Investment makes every effort to ensure that the information on this website is accurate and complete at the time of its inclusion, it gives no warranty as to the accuracy or completeness of such information. BEA Union Investment, its affiliates, directors, officers or employees accept no liability for any errors or omissions relating to information available through this website. BEA Union Investment shall not be responsible for any consequence of any action carried out by any user of this website, whether authorised or otherwise. Furthermore, BEA Union Investment shall not be responsible for any errors or omissions relating to specific information provided by any third party.

Investment Product Information

This website may contain information relating to investment products and services. Some of these investment products may be collective investment schemes ("funds") authorised by the SFC. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. Investment products which have not been authorised by the SFC are not available to the retail public in Hong Kong. Certain funds are registered as restricted schemes in Singapore and are made available to the eligible accredited investors only and are not for sale to general public in Singapore.

This website is intended for Hong Kong residents only. Non-Hong Kong residents are responsible for observing all applicable laws and regulations of their relevant jurisdictions before accessing the information contained herein. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. The investment products and services mentioned in this website are not intended for individuals in the European Union.

The information contained in this website does not constitute a distribution, an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction in which the distribution or offer is not authorised, including without limitation to, the United States of America (“U.S.”) or for the benefit of U.S. persons (being U.S. residents or partnerships or corporations organised under the U.S. laws). Potential investors are responsible for informing themselves as to the legal and any other applicable requirements or restrictions under the laws of their own jurisdictions.

Information contained in this website does not constitute investment advice or recommendations. An investment in funds mentioned in this website may not be suitable for all investors and if you have any doubt about any of the information on this website, you should seek independent professional financial advice.

The commentaries and/or views expressed herein are the views of the writer at the time of issue and may change over time. Analysis contained herein is based on numerous assumptions which may cease to be valid over time. No person should rely on the content and/or act on the basis of any matter contained on this website without obtaining specific professional advice.

Potential investors are responsible for determining whether any investment, security or strategy, or any other product or service is appropriate or suitable for them based on their investment objectives and personal and financial situation. No assurance can be given that the investment objective of any investment products will be achieved. No representation or promise as to the performance of any investment products or the return on an investment is made.

Investment involves risks. Units or shares in funds mentioned on this website may only be bought and sold on the terms set out in the relevant Hong Kong offering documents, as applicable. Investments in emerging markets and smaller companies may involve a higher degree of risk and are usually more sensitive to price movements. Past performance, projection, or forecast included in this website is not a guide to future returns and investors should be aware that the value of units or shares and the income from them may fall as well as rise and they may not get back the full amount invested. Exchange rates may also cause the value of the underlying overseas investments to go up or down. Potential investors should read the terms and conditions contained in the relevant offering documents and in particular the investment policies and the risk factors before any investment decision is made. Investors should ensure they fully understand the risks associated with the relevant fund and should also consider their own investment objective and risk tolerance level.

Content Update and Downloading Disclaimers

BEA Union Investment does not undertake any obligation to update this website or any website content. BEA Union Investment shall not be liable to any user or any third party for any damages arising from any actions or investment decisions taken based on the accuracy (or otherwise) of the data presented through this website.

BEA Union Investment does not warrant that any downloads from this website will meet user needs or expectations, or be uninterrupted, secure or error free or that any files available for downloading through this website are free of computer viruses or other harmful components. Users themselves are responsible for ensuring adequate protection and backup of data, software, computer and other equipment is made and appropriate safeguard is in place to detect, prevent and eliminate computer viruses and other harmful effects. BEA Union Investment or its affiliates will not be responsible for any costs or expenses which may be incurred if the use of this website or the delivery of information or downloads results in any servicing or replacement of property, material, equipment or data.

Links to Other Websites

This website may provide links to other websites. These links are provided only for information purpose. BEA Union Investment does not verify or endorse the accuracy of the information provided by or mentioned in such websites. Such websites may contain products and services that are not authorised in Hong Kong and not available to Hong Kong residents. You use such links entirely at your own risk. BEA Union Investment therefore accepts no liability for their content or for the products, services or other offers available through them.

Limitation of Liability

BEA Union Investment or its affiliates, or any of their respective directors, officers, employees or agents shall not be liable for any event of force majeure, any virus or other harmful component affecting this website or any server that operates it, any interception of data or communications in connection with the public nature of the internet, any problems or technical malfunction of any telephone network or lines, computer online systems, servers or providers, computer equipment, software failure of any email or entry to be received on account of technical problems or traffic congestion on the Internet, telephone lines or at any website, or any combination thereof, including any loss of opportunities or profit arising from any time delay, system disruption or interruption, transmission blackout, delayed transmission or any incorrect data transmission, or any injury or damage to the computer or other electronic devices or property of any person accessing their website or any other person related to or resulting from accessing this website or downloading any materials from this website of BEA Union Investment or any third party.

BEA Union Investment or its affiliates, or any of their respective directors, officers, employees or agents shall not be liable for any and all losses, injury (including special, indirect and consequential losses), damages, rights, claims and actions of any kind resulting from accessing or downloading any materials from this website BEA Union Investment or any third party, including without limitation, personal injuries, death and property damage.

Intellectual and Other Property Rights

All copyright, trademark, logo, patent, intellectual and other property rights in the information contained herein are the exclusive property of BEA Union Investment or its affiliates, except as otherwise stated. No rights of any kind are licensed or assigned or shall otherwise pass to persons accessing such information. Under no circumstances should information contained herein or any part of it be copied, reproduced or redistributed without BEA Union Investment's express written consent.

Indemnification

As a condition of your use of this website, you agree to make BEA Union Investment and its third party providers whole for any and all claims, losses, liabilities and expenses (including but not limited to attorney's fees) arising from any use of this website or your violation of these Terms of Use.

Data Privacy

Please read our Privacy Policy Statement and Personal Information Collection (Customers) Statement before providing BEA Union Investment with any personal information on this website. By providing any personal information on this website, you will be deemed to have read and accepted our Privacy Policy Statement and Personal Information Collection (Customers) Statement.

Cookies

BEA Union Investment may use cookies to track your visits to the website. The information collected is for us to understand more about our users including user demographics, interests and usage patterns, and to improve the effectiveness of our online marketing. Please refer to our Privacy Policy Statement for more information about the use of cookies. If you do not wish to have cookies stored on your computer, you can disable them by changing the settings on the web browsers but certain features on BEA Union Investment’s website will not work properly..

Governing Law

These Terms of Use shall be governed in all respects by the laws of Hong Kong.

You shall comply with all laws, rules and regulations by any governmental authority or agency which govern or apply to the operation and use of this website. These Terms of Use inures to the benefit of BEA Union Investment, its successors and assigns. You may not assign these Terms of Use. No waiver to these Terms of Use shall be effective unless agreed in writing by BEA Union Investment. All rights not expressly granted herein are reserved by BEA Union Investment.

Please click the "ACCEPT" button below to acknowledge that you have read and understood the information and agree to abide by its contents, otherwise click "EXIT" to leave the website.

Asia's economy is in a different position than that of the US and Europe. While inflation in developed market is driven by services, Asia's prices are still led by goods. While the region's economy is relatively stable, interest rates of several Asian countries have already peaked or are approaching the peaks. Indonesia, Korea and Malaysia, have already put rate hike on hold, citing current levels deemed suffice to control core inflations that are easing. Among them, our investment teams find Indonesia's property high yield bonds appealing. Selected Korea's investment-grade bonds are also attractive. China's reopening will instill growth in the region. Favourable policies will continue to bolster Chinese high yield property and industrial bonds.

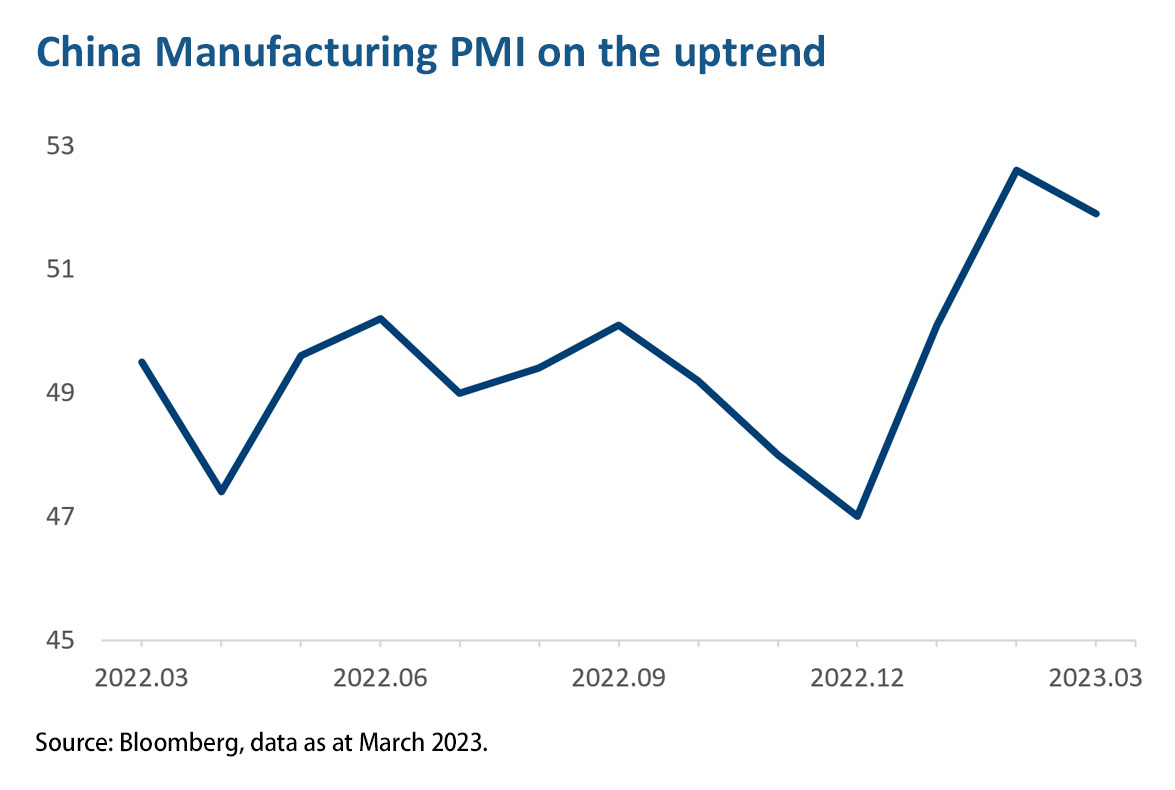

Asia's economy is in a different position than that of the US and Europe. While inflation in developed market is driven by services, Asia's prices are still led by goods. While the region's economy is relatively stable, interest rates of several Asian countries have already peaked or are approaching the peaks. Indonesia, Korea and Malaysia, have already put rate hike on hold, citing current levels deemed suffice to control core inflations that are easing. Among them, our investment teams find Indonesia's property high yield bonds appealing. Selected Korea's investment-grade bonds are also attractive. China's reopening will instill growth in the region. Favourable policies will continue to bolster Chinese high yield property and industrial bonds.  After the abrupt U-turn of covid, property and internet policies, the Chinese economic recovery is on track. Apart from recovery in traveling and entertainment, improvement can also be seen across consumer spending, industrial output and property markets. Retail sales jumped 3.5% in January and February from a year earlier, while industrial output registered a healthy rebound of 2.4%, thanks to increasing infrastructure spending.

After the abrupt U-turn of covid, property and internet policies, the Chinese economic recovery is on track. Apart from recovery in traveling and entertainment, improvement can also be seen across consumer spending, industrial output and property markets. Retail sales jumped 3.5% in January and February from a year earlier, while industrial output registered a healthy rebound of 2.4%, thanks to increasing infrastructure spending.