Mitigate Volatility and Seek Stability amid Uncertainty

US tariff policies are unsettling global markets, heightening the risk of rising core inflation and a slowdown in economic growth.

Diverging monetary policies among central banks and ongoing geopolitical tensions continue to drive market volatility, with inflation risks still lingering.

It is sensible to focus on seeking sustainable income, reducing the impact of volatility and uncertainty, while maintaining liquidity. Diversification is the cornerstone of the investment approach.

Short-term investment-grade bonds: a high-quality defensive asset

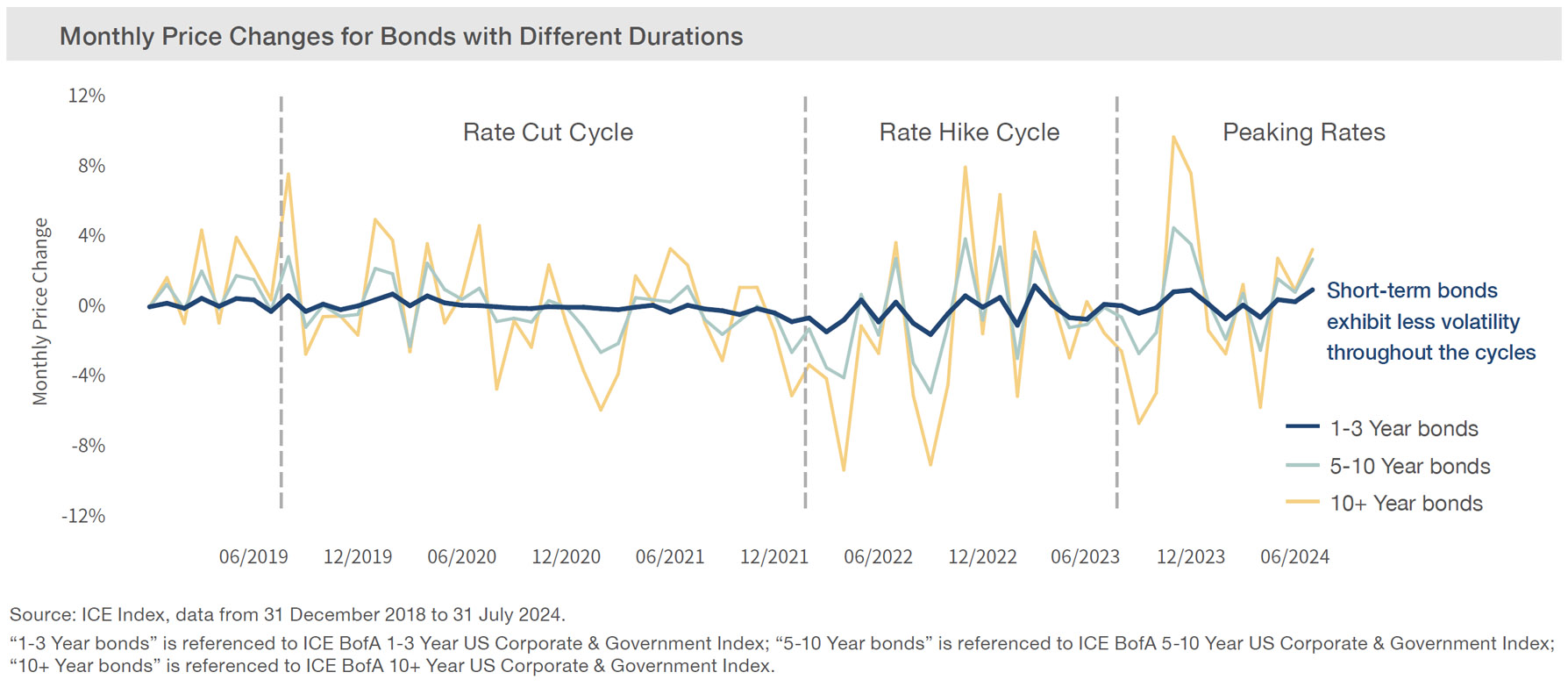

Short-term investment-grade bonds are less sensitive to rate movements, and are relatively unaffected by changing rates.

Shorter maturities facilitate the assessment of issuers' financial situations, business operations and financial metrics, among others, which can help reduce credit risks.

Mark-to-market risk is relatively lower, allowing greater investment flexibility and allocation.

Why invest in short-term bonds now?

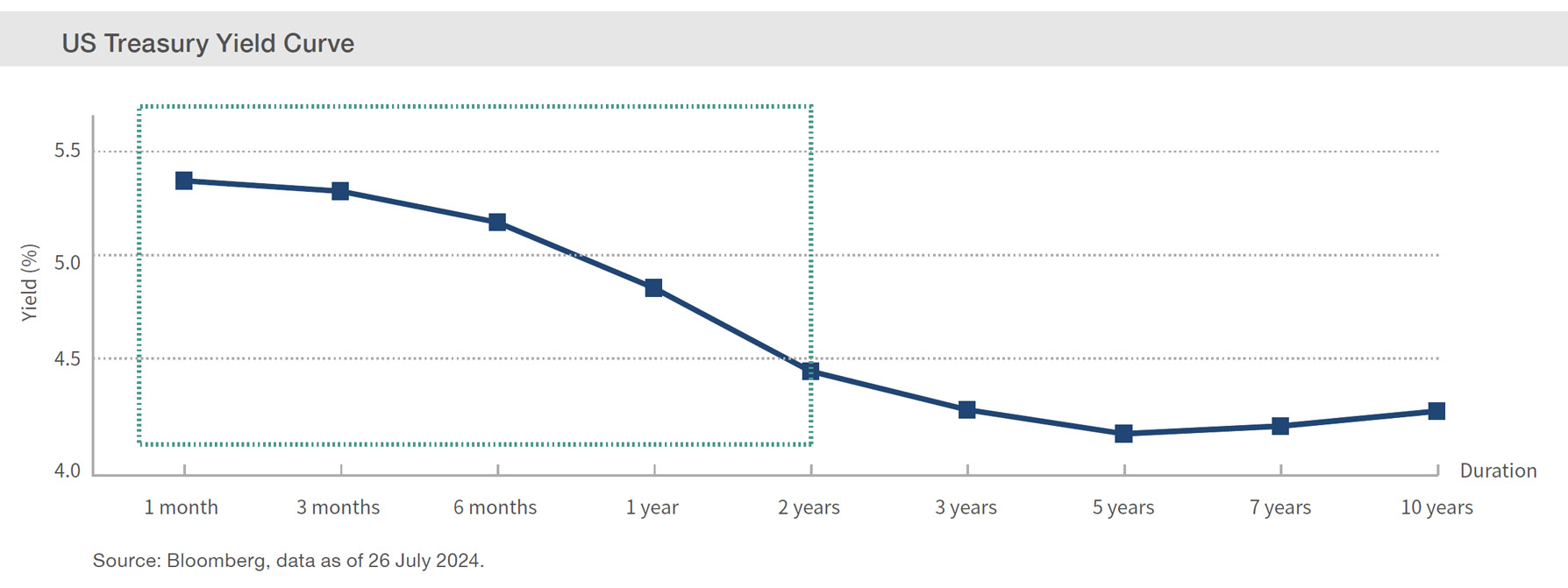

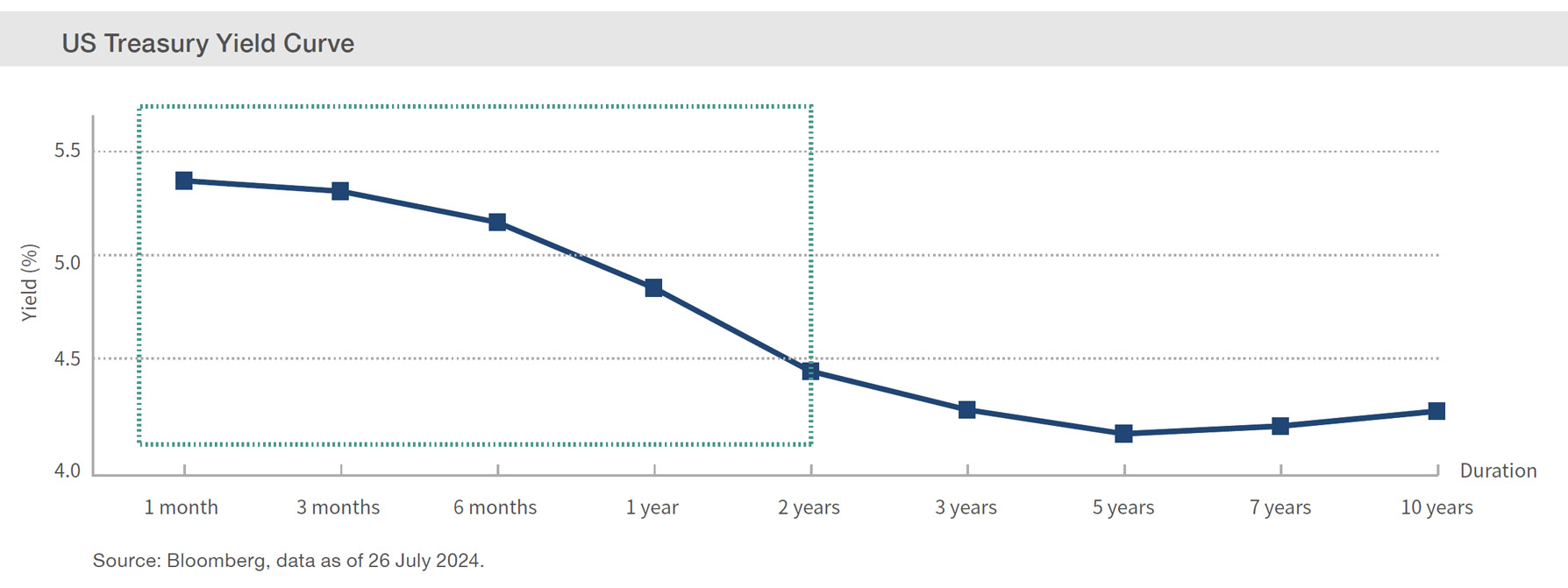

In an environment of uncertain interest rate direction, short-term bonds generally exhibit lower price volatility, offering protection against interest rate changes.

With increasing economic uncertainties, short-term bonds serve as a defensive component within investment portfolio, helping to diversify the overall risk.

The current market conditions present a favorable window to invest in short-term bonds, allowing investors to capture relatively higher yields.

BEA Union Investment Global Quality Bond Fund characteristics

Navigate market changes, supporting your pursuit of stable income

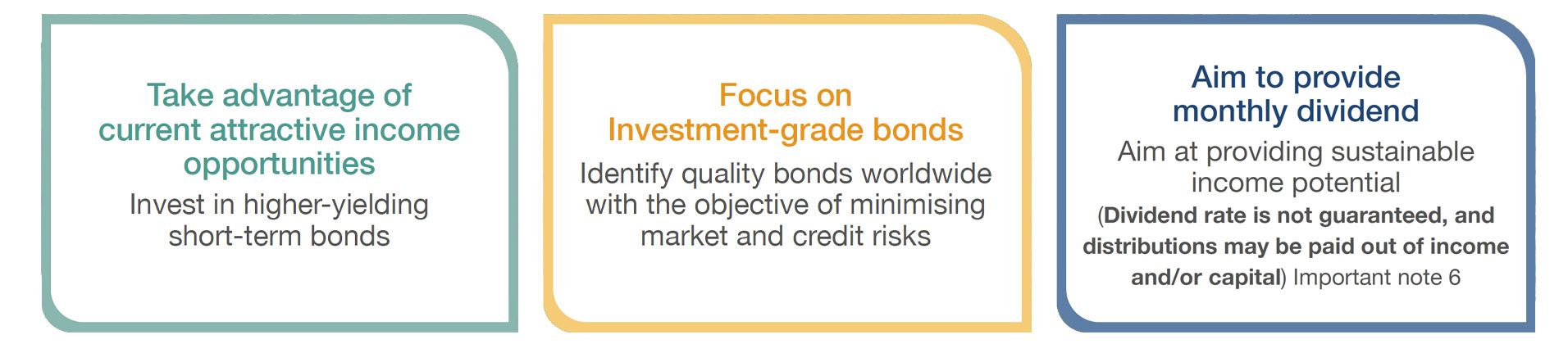

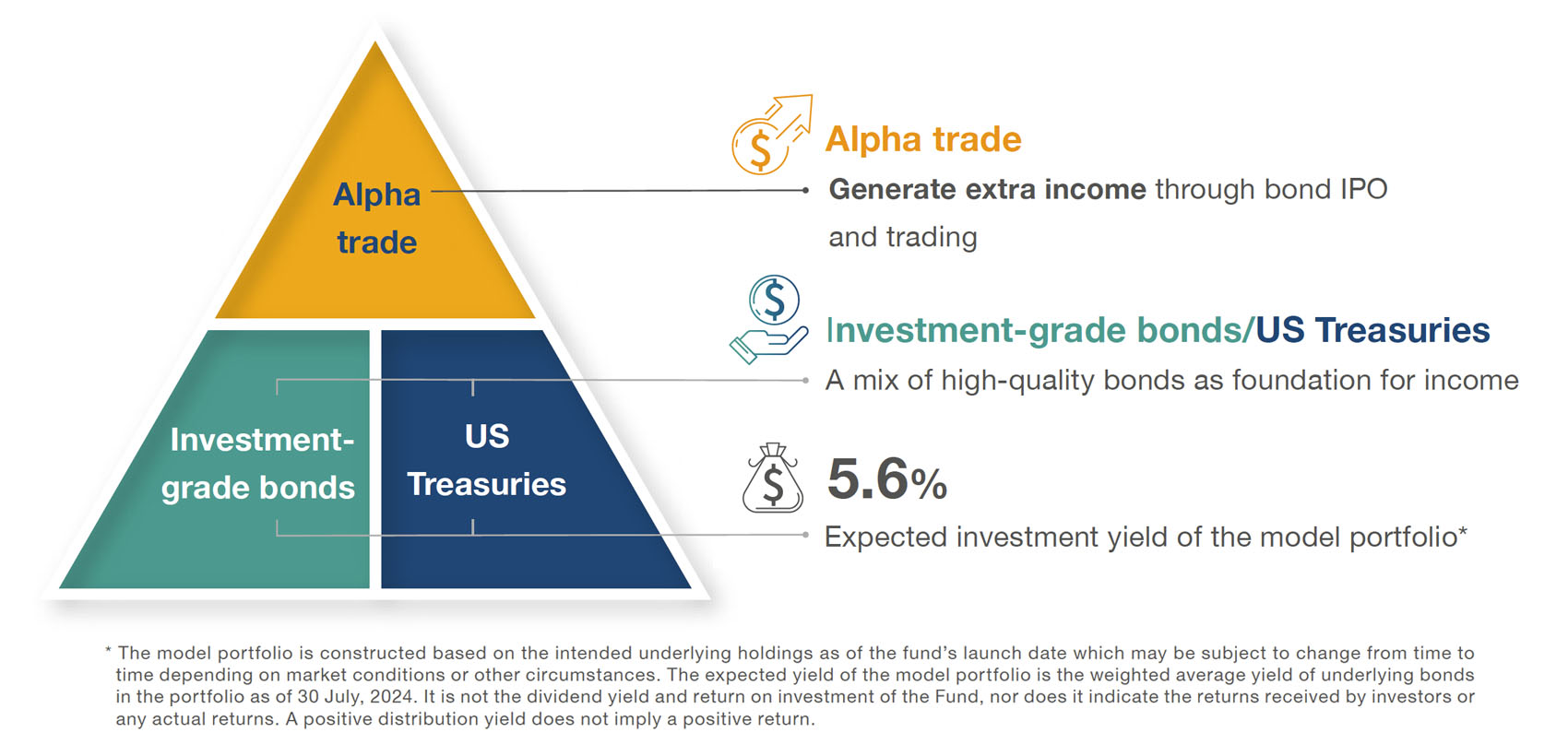

Capture attractive total return potential

Capture attractive total return potential

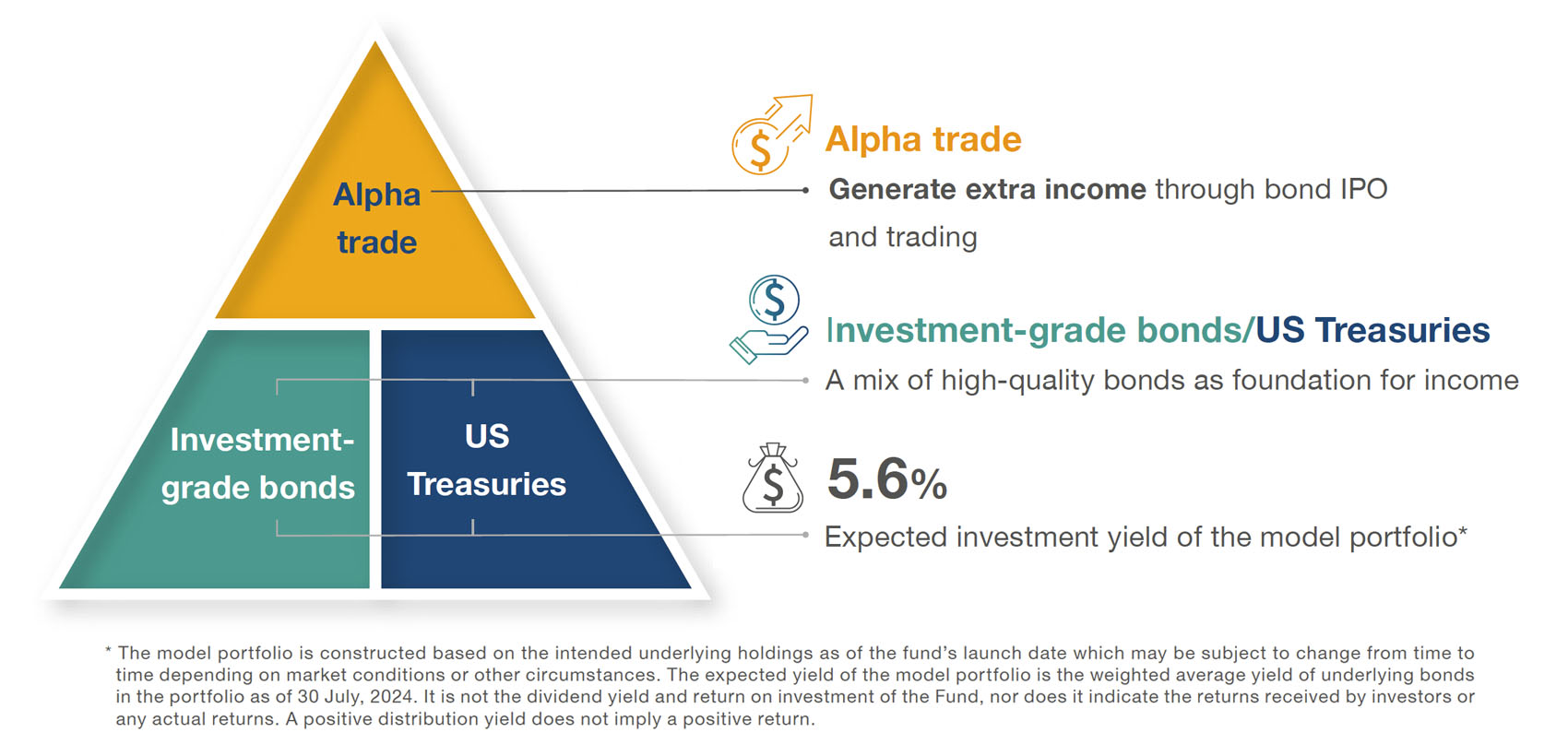

Enhance portfolio yield and credit quality with high-quality short-term investment-grade corporate bonds, complemented by US Treasuries for liquidity

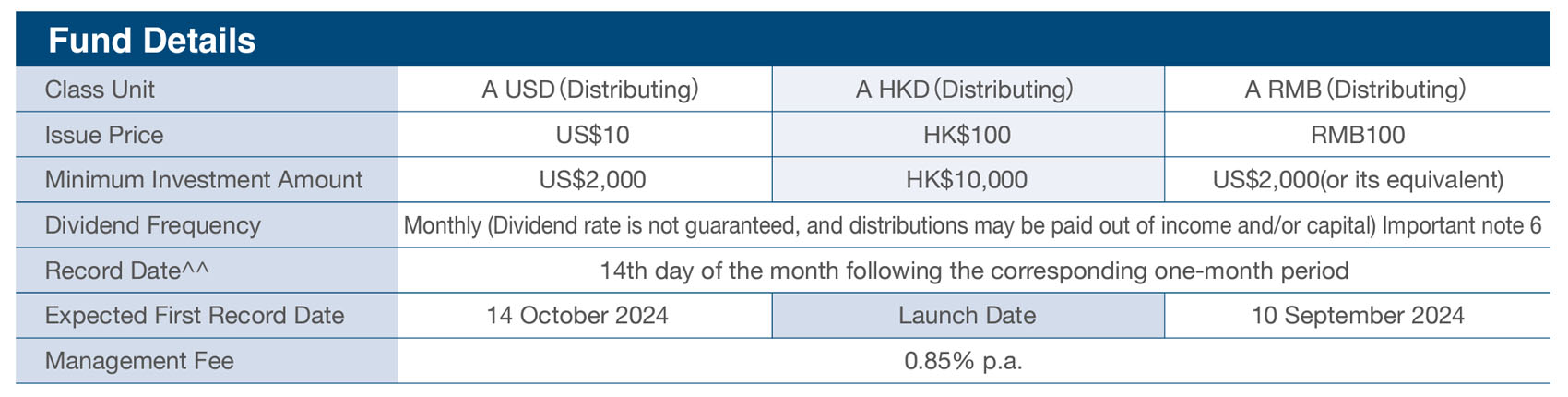

Aim to provide monthly dividend, with current annualized dividend yield of 5.4%2 (Dividend rate is not guaranteed, and distributions may be paid out of income and/or capital) Important note 5

Short-term bond allocations as a defensive strategy

Short-term bond allocations as a defensive strategy

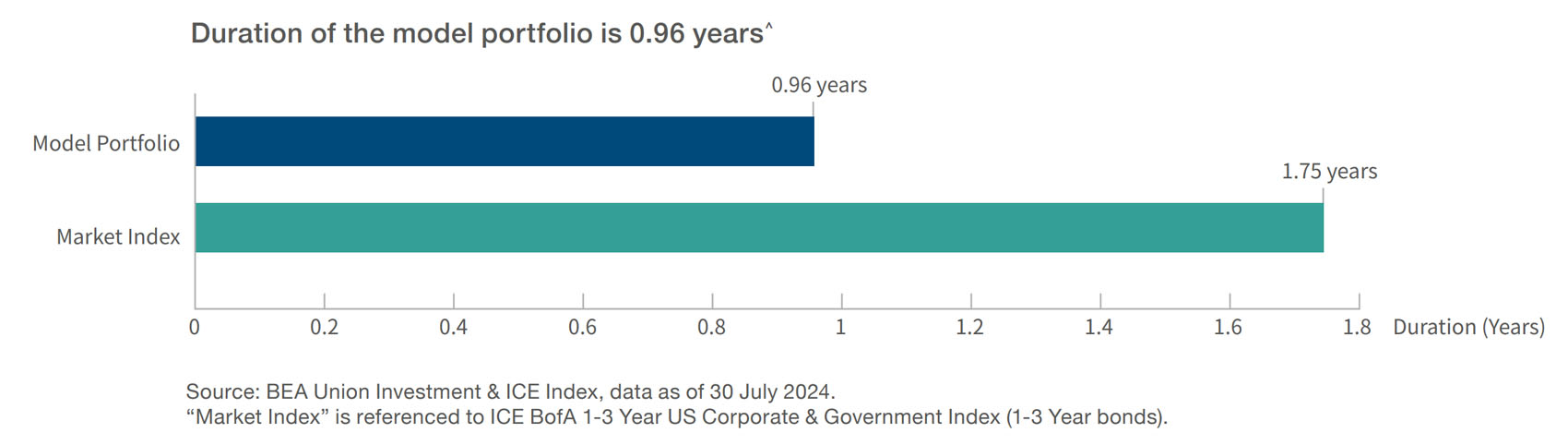

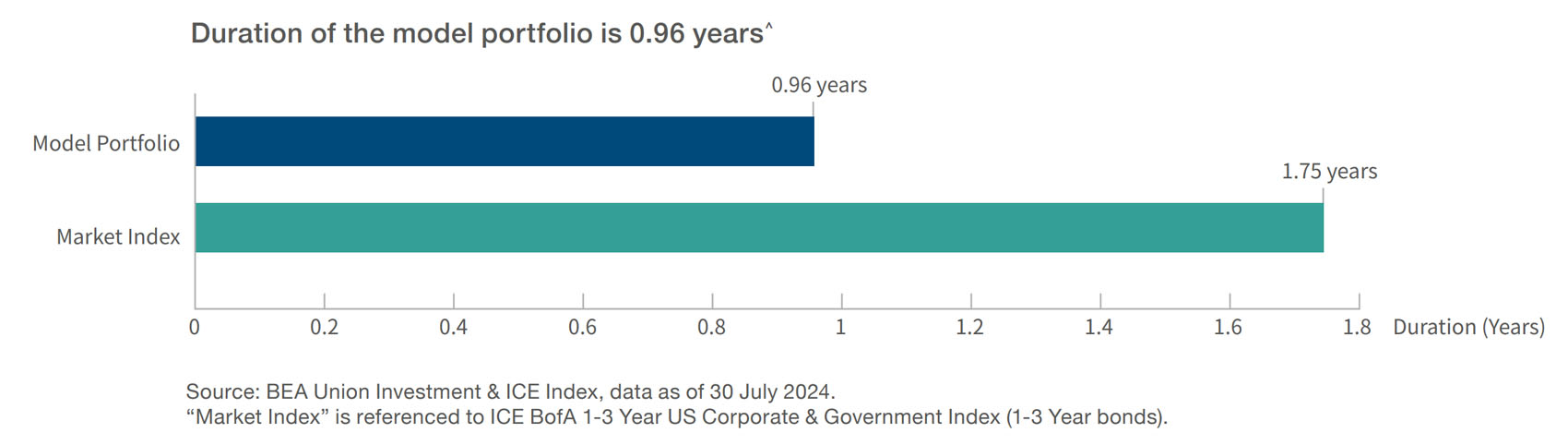

The fund maintains a short duration strategy, with the current portfolio duration approximately 1 year, helping to reduce price volatility during market adjustments.

Meticulous selection of quality assets to reduce investment risks

Meticulous selection of quality assets to reduce investment risks

100% Investment-Grade Bond Allocation1

Flexible allocation, diversified portfolio, striving for enhanced performance

Flexible allocation, diversified portfolio, striving for enhanced performance

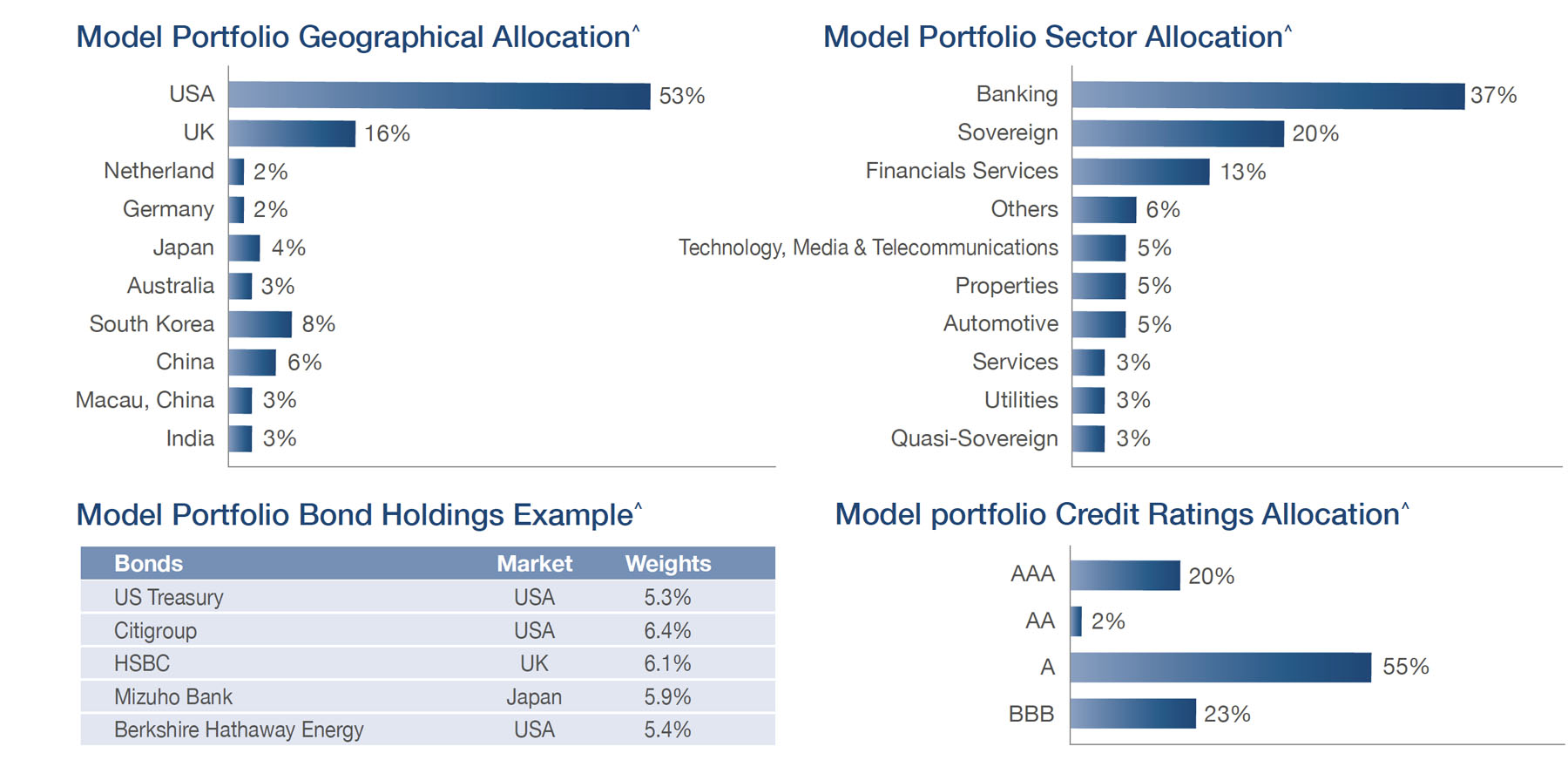

About 80% of the fund is invested in developed markets, including the US, Europe, Japan and Australia.

Diversify investment across USD-denominated bonds from various global sectors to reduce volatility amidst the current economic situation

![]()

US tariff policies are unsettling global markets, heightening the risk of rising core inflation and a slowdown in economic growth.

![]()

Diverging monetary policies among central banks and ongoing geopolitical tensions continue to drive market volatility, with inflation risks still lingering.

![]()

It is sensible to focus on seeking sustainable income, reducing the impact of volatility and uncertainty, while maintaining liquidity. Diversification is the cornerstone of the investment approach.

Short-term investment-grade bonds: a high-quality defensive asset

|

|

Short-term investment-grade bonds are less sensitive to rate movements, and are relatively unaffected by changing rates. |

|

|

Shorter maturities facilitate the assessment of issuers' financial situations, business operations and financial metrics, among others, which can help reduce credit risks. |

|

|

Mark-to-market risk is relatively lower, allowing greater investment flexibility and allocation. |

Why invest in short-term bonds now?

|

|

In an environment of uncertain interest rate direction, short-term bonds generally exhibit lower price volatility, offering protection against interest rate changes. |

|

|

With increasing economic uncertainties, short-term bonds serve as a defensive component within investment portfolio, helping to diversify the overall risk. |

|

|

The current market conditions present a favorable window to invest in short-term bonds, allowing investors to capture relatively higher yields. |

BEA Union Investment Global Quality Bond Fund characteristics

1. Source: BEA Union Investment, as at 30 April 2025.

2. Source: BEA Union Investment, the mentioned dividend yield is for A HKD(Distributing) for April 2025. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Please refer to the online dividend distribution records for the dividend components and details. Past dividend record is not indicative of future dividend likely to be achieved. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholder's original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit/share. Please note that a positive distribution yield does not imply a positive return. Investors should not make any investment decision solely based on information above. You should read the relevant offering document (including the key facts statement) of the fund for further details including the risk factors.

3. Source: Union Investment, as at 31 March 2025.

4. Organisations which have granted awards to BEA Union Investment include Asia Asset Management, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com, Refinitiv Lipper, The Asset, Insights & Mandate, Morningstar, Bloomberg Businessweek, China Fund News and MPF Ratings.

*Including investment professionals of Union Investment and BEA Union Investment

Important note:

1. BEA Union Investment Global Quality Bond Fund (the "Fund") seeks medium to long term capital growth and regular income by primarily investing in a portfolio of global investment-grade debt securities.

2. The Fund is subject to general investment risk, emerging market risk, derivative risk and currency risk.

3. The Fund invests in debts securities and are subject to risks in interest rates, credit/counterparty, downgrading, below investment grade or non-rated securities, volatility and liquidity, valuation and sovereign debt, credit rating risks which may adversely affect the price of the debt securities.

4. The Fund's investment in debt instruments with loss-absorption features are subject to risks of being written down or converted to ordinary shares upon the occurrence of complex and unpredictable trigger event which may result in a significant or total reduction in the value of such instruments. These debt instruments may also be exposed to liquidity, valuation and sector concentration risk.

5. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholders original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

6. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

7. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors' investments.

8. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

9. Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the explanatory memorandum of the Fund. Investors should also read the explanatory memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance.

The Fund has been authorised by the Securities and Futures Commission ("SFC") in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

Main Distributors (In no particular order):

|

|

|

|