BU Global Flexi Allocation Fund

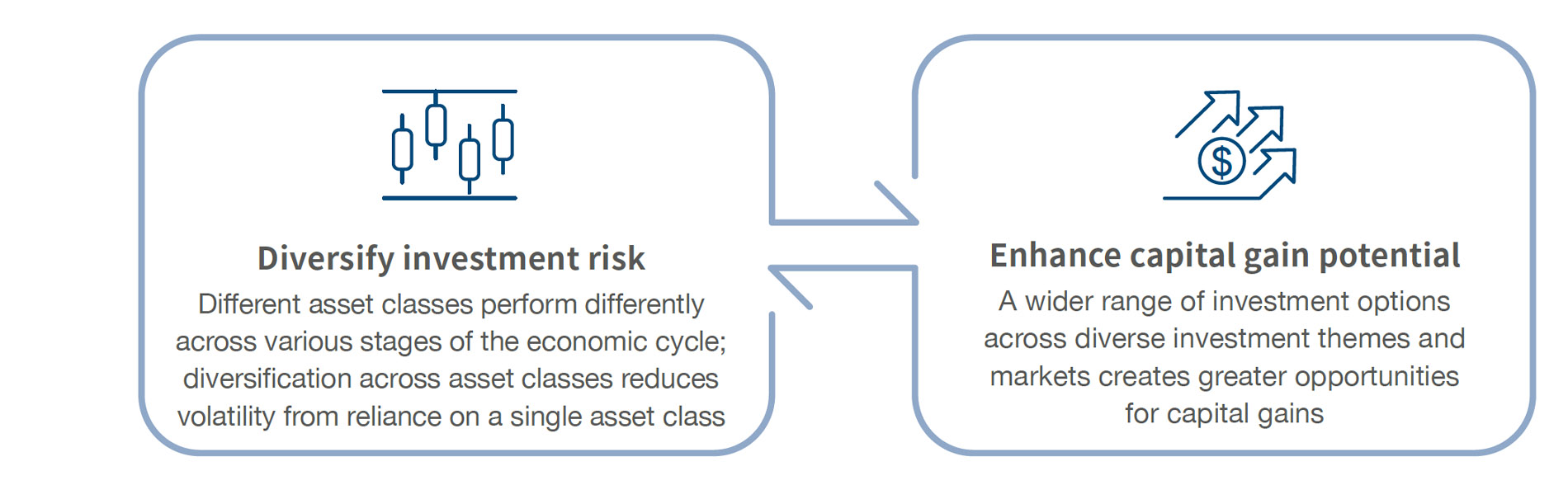

Why opt for a multi-asset investment strategy

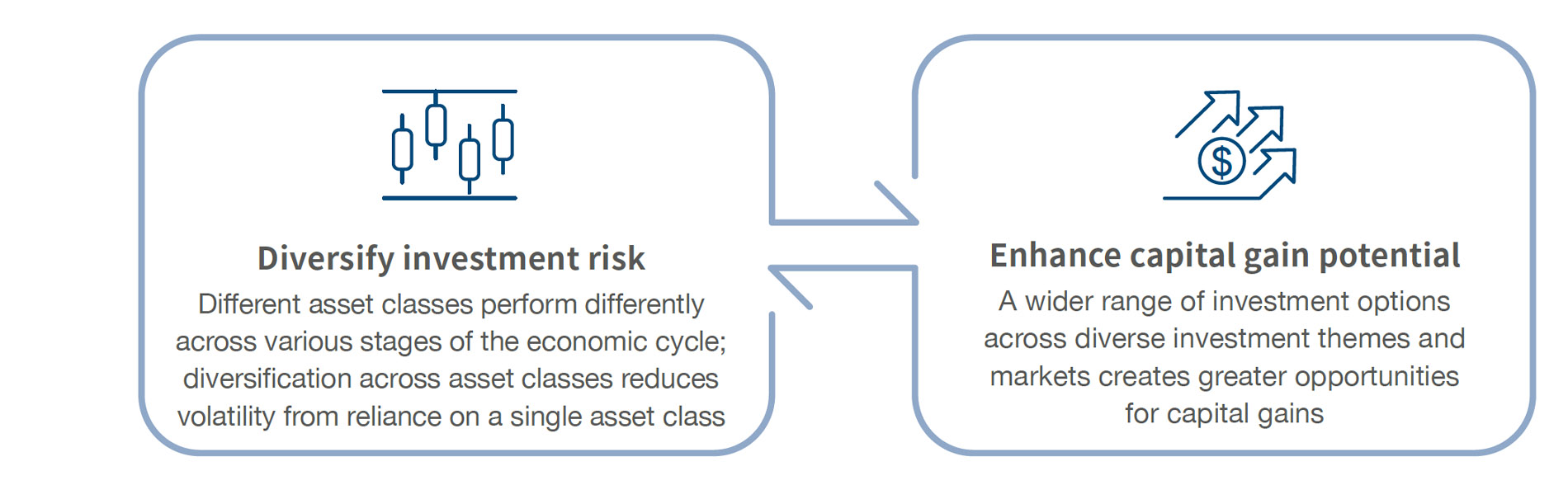

Multi-asset investment portfolio invests across a spectrum of assets, such as equities, bonds and commodities

Provides an opportunity to diversify risk while optimising returns in today's dynamic market environment

Risk Management as Fundamental for Enhanced Advantages

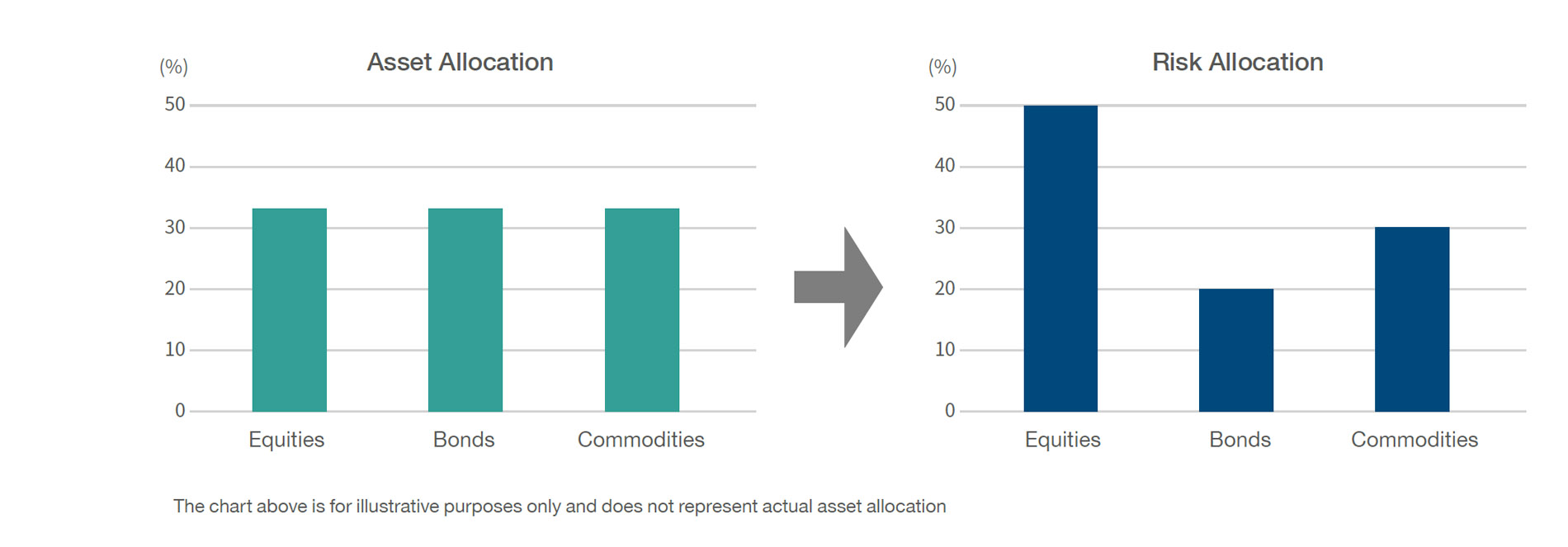

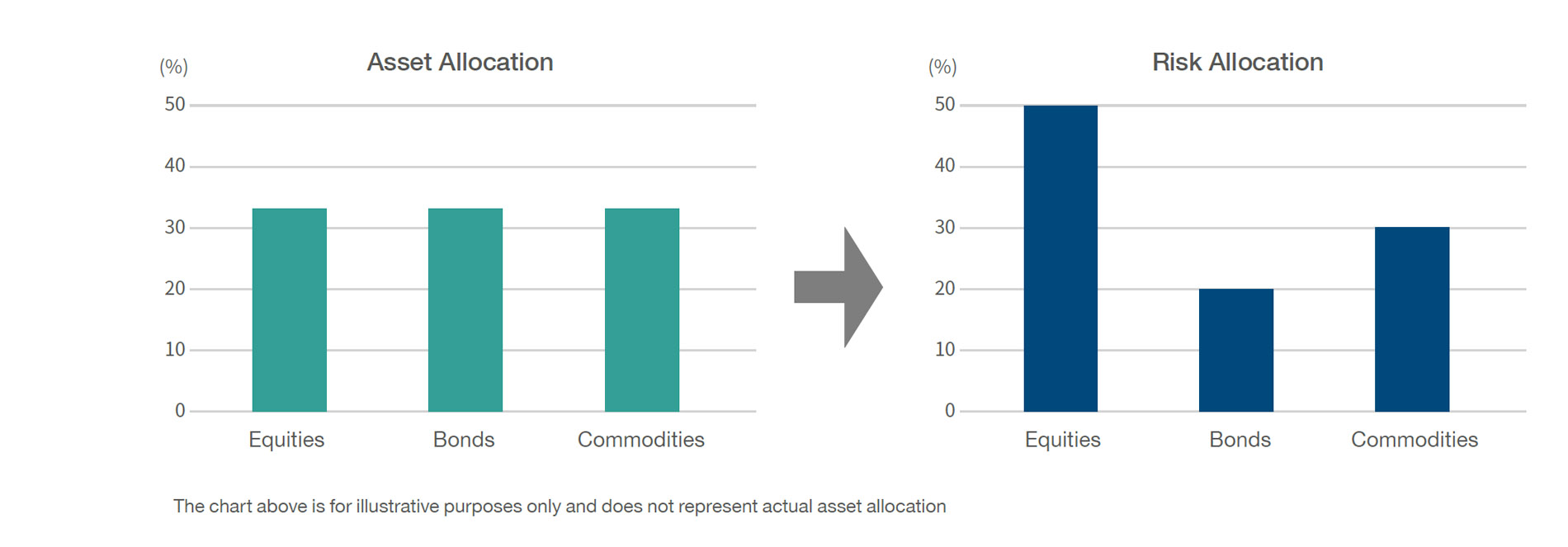

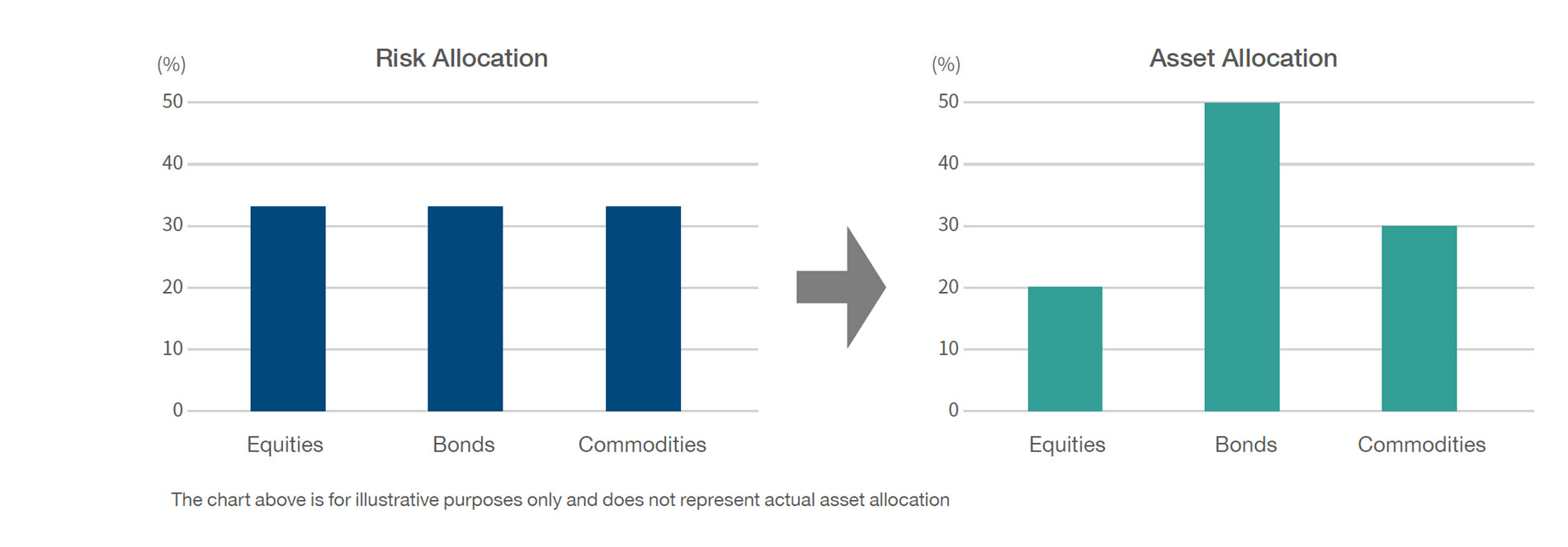

Asset Allocation-First Investment Portfolio – Construct the portfolio, then manage risk

With predetermined asset class ratios, investment risk may change with market fluctuations, and leading to a possible mismatch between risk and asset allocation ratios

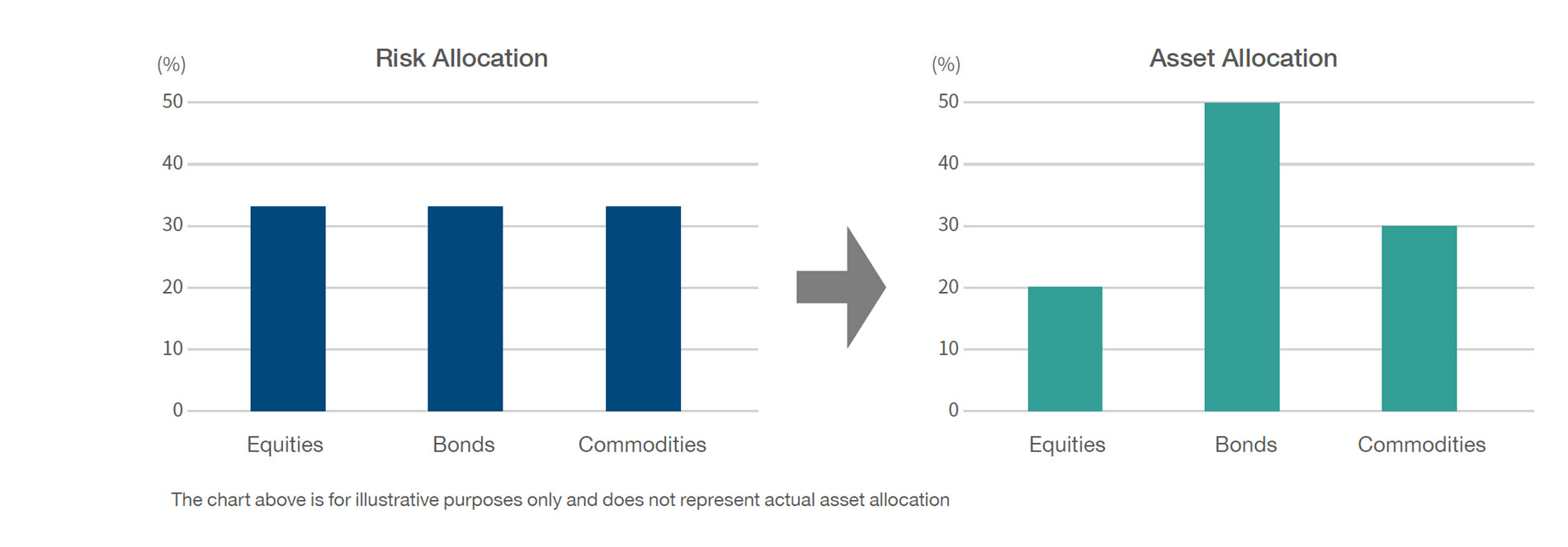

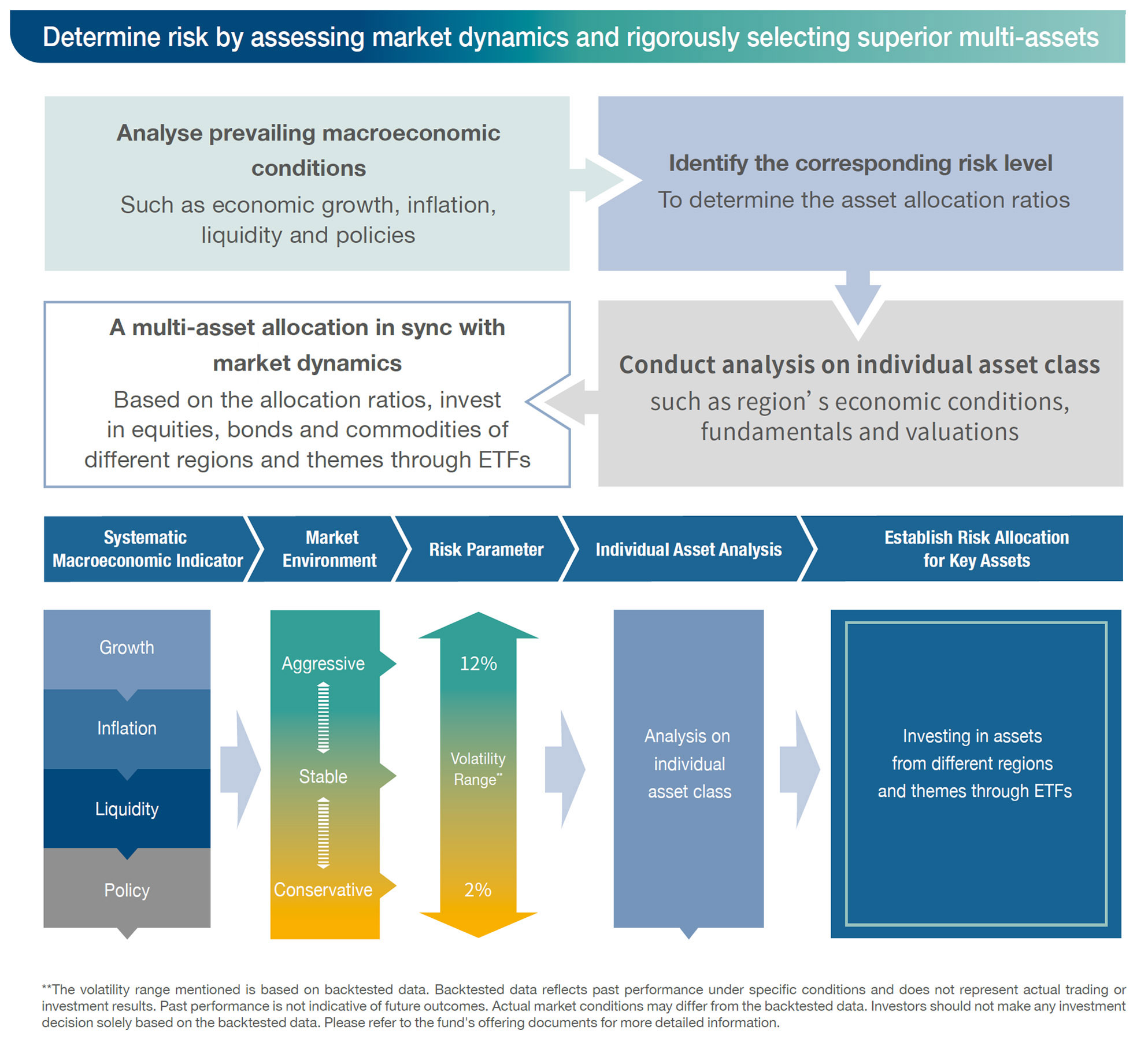

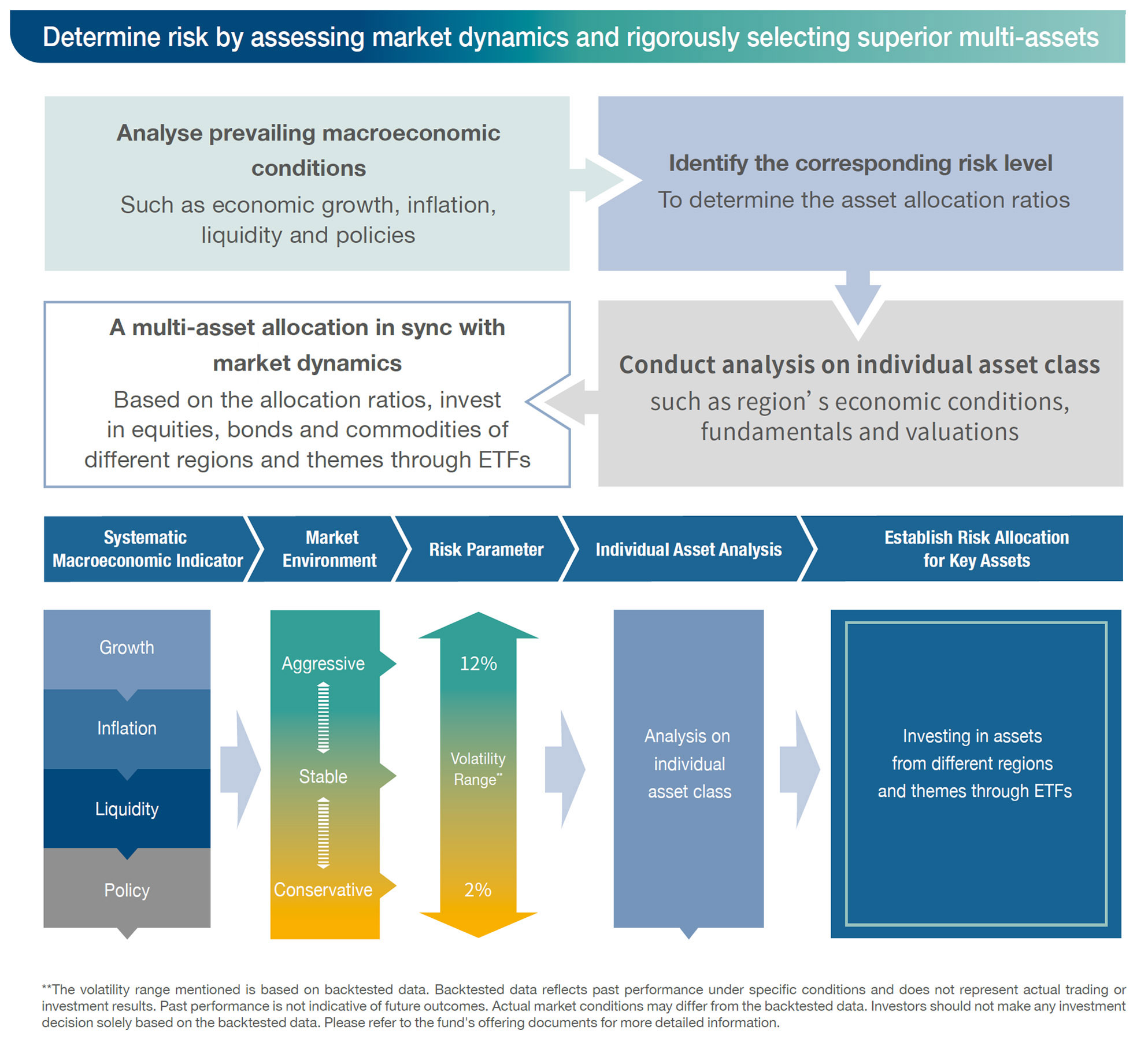

Risk-based Multi-asset Portfolio - Manage risk, then construct the portfolio

Assess risks before determining asset allocation, allowing for more effective control of portfolio risk and achieving a better balance between risk and return

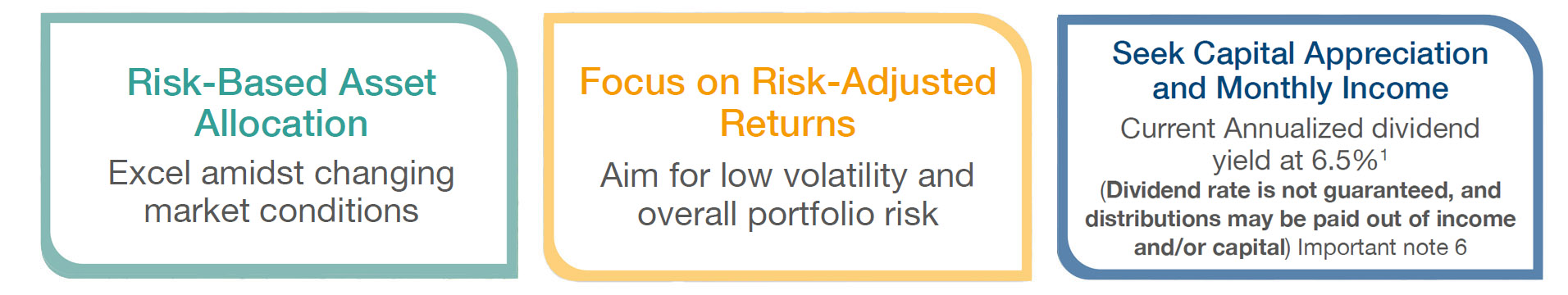

BU Global Flexi Allocation Fund Characteristics

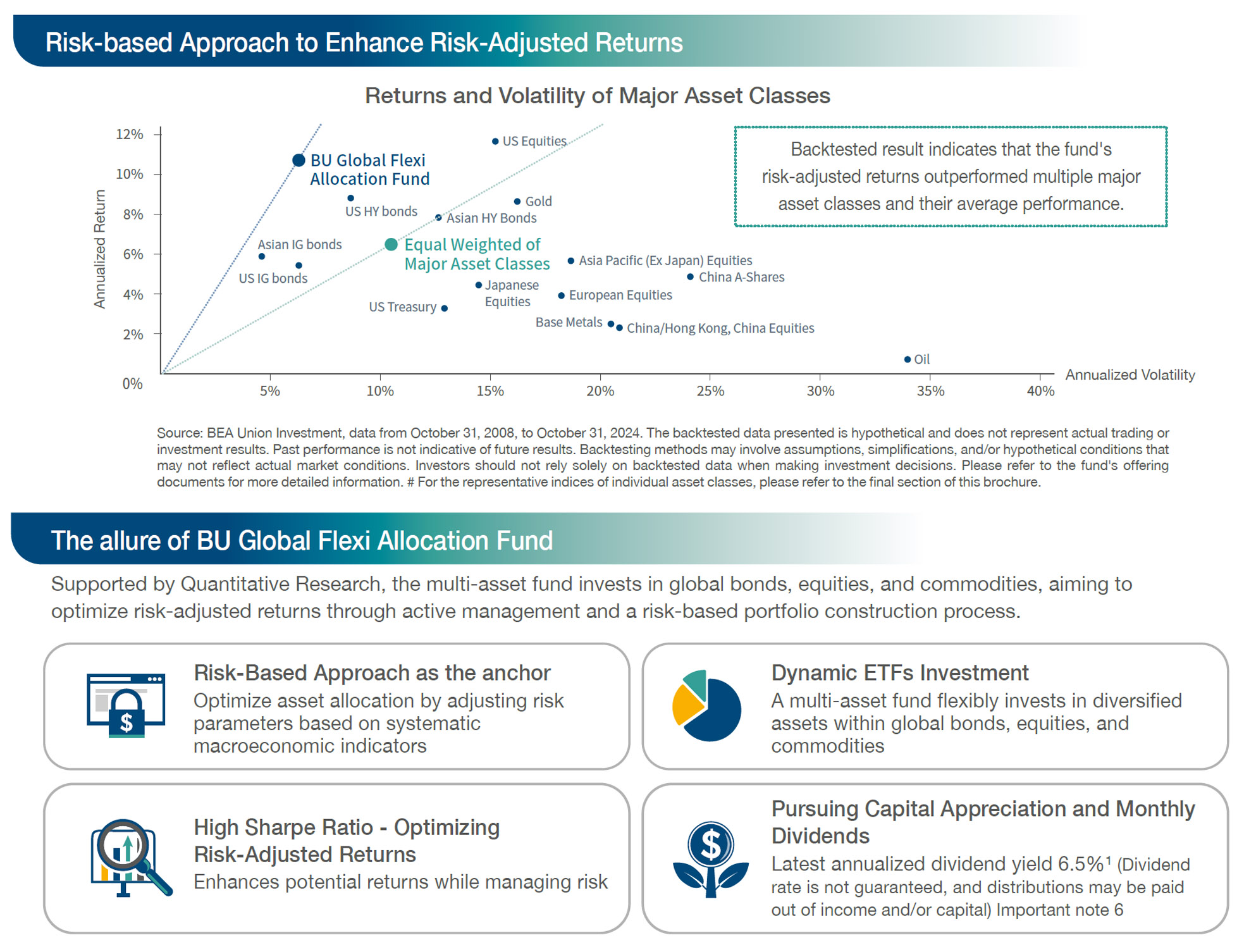

An investment portfolio that aligns with market conditions

Broadly participate in diverse markets and asset classes through investing in ETFs across different regions and themes*

1 Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) for November 2024. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return. The directors may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the

shareholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per share.

Important note:

1. BU Global Flexi Allocation Fund ("the Fund") is a sub-fund of BU Investment Series OFC ("the Company"), which is a public open ended fund company ("OFC") (business registration number 72687438) regulated under the laws of Hong Kong, with variable capital and limited liability and segregated liability between sub funds.

2. The Fund invests in emerging markets and may be subject to higher liquidity and volatility risks.

3. The Fund invests in debts or fixed income securities are exposed to interest rates, credit/counterparty, downgrading, volatility and liquidity, valuation and sovereign debt and credit rating risks which may adversely affect the price of the debt securities.

4. The Fund is subject to equity markets risk such as changes in investment sentiment, political, economic conditions and issuer specific factors which may adversely affect the fund value.

5. The Fund may invest in below investment grade and non- rated debt securities, which are subject to greater volatility and liquidity risks than higher rated securities.

6. The directors may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the shareholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per share.

7. In terms of currency hedged class shares, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class shares may result in a decrease in return and/or loss of capital for shareholders. Over hedged or under hedged positions may arise and there can be no assurance that the currency hedged class shares will be hedged at all times or that the manager will be successful in employing the hedge.

8. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors’ base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors’ investments.

9. The Fund may acquire financial derivative instruments for hedging and investment purposes. Given the leverage effect embedded in financial derivative instruments, the Fund may be exposed to significant losses.

10. Investors should not make an investment decision based solely on this material.

^^ If such day is not a business day, the record date will be the immediately preceding business day.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the prospectus of the Fund. Investors should also read the prospectus of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund.

Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The Fund has been authorised by the Securities and Futures Commission ("SFC") in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

‡ Source: Union Investment, as of September 30, 2024. BEA Union Investment is an independently operated investment management company established as a joint venture between The Bank of East Asia and Germany's Union Investment. The company adheres to relevant regulatory requirements to implement business separation between the company and its shareholders.

† The Fund achieving awards from The Asset, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com and Lipper.

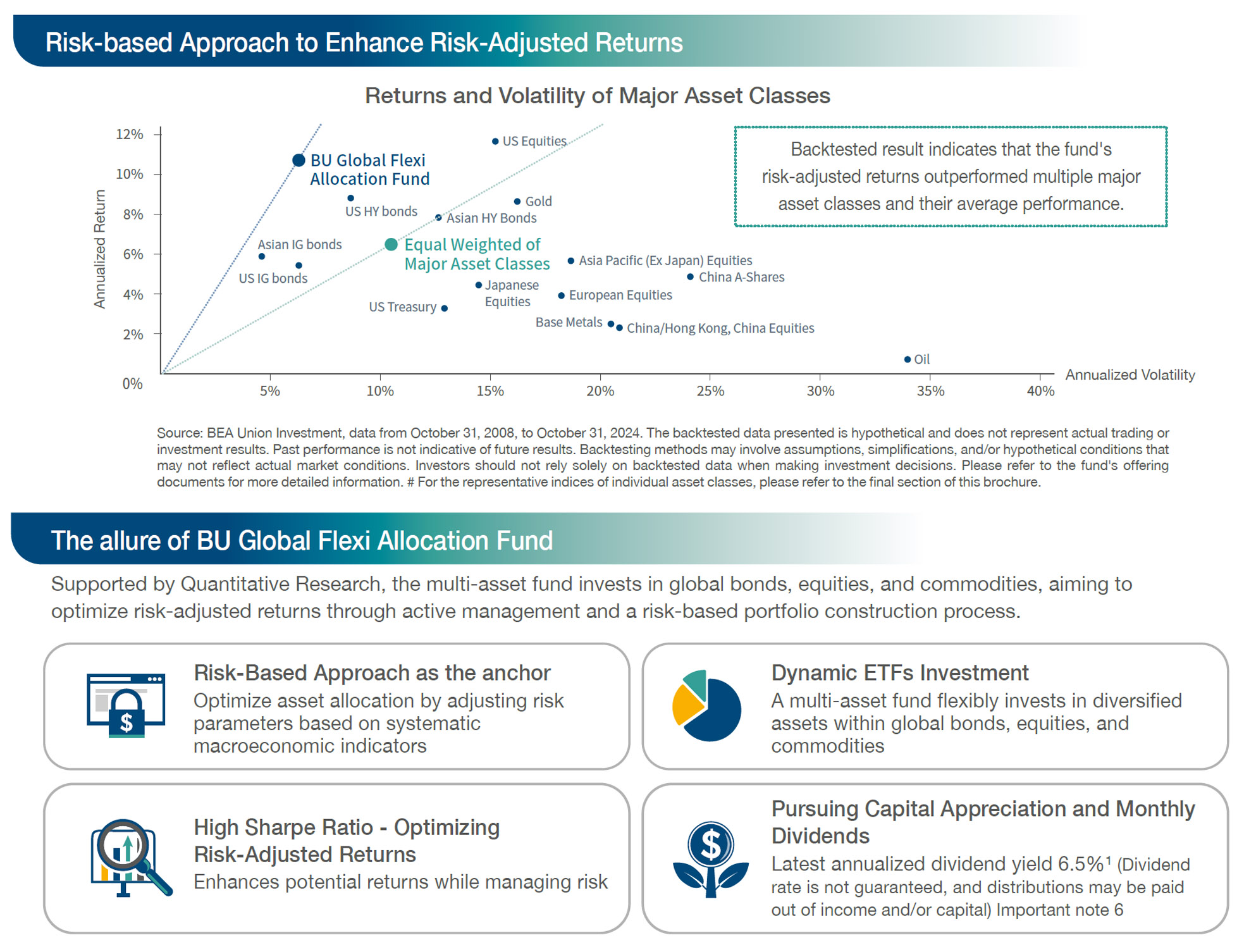

# The asset classes mentioned are represented by the following indices: US Equities - S&P 500 Index; European Equities - MSCI Europe Index; Japanese Equities

-Tokyo Stock Price Index (TOPIX);Asia Pacific (Ex Japan) Equities: MSCI AC Asia Pacific ex Japan Index; China/Hong Kong, China Equities - Hang Seng Index;

China A-Shares - MSCI China A Onshore Index; US Treasury - ICE BofA US Treasury Index (10+ years); US IG bonds: ICE BofA US Corporate Index; US HY bonds

- ICE BofA US High Yield Index; Asian IG bonds: ICE BofA Asian Dollar Investment Grade Corporate Index; Asian HY Bonds: ICE BofA Asian Dollar High Yield

Corporate Index; Oil - Brent Crude Oil Futures; Gold - Gold USD; Base Metals - Bloomberg Industrial Metals Subindex Total Return

Main Distributors (In no particular order):

![]()

Multi-asset investment portfolio invests across a spectrum of assets, such as equities, bonds and commodities

![]()

Provides an opportunity to diversify risk while optimising returns in today's dynamic market environment

Risk Management as Fundamental for Enhanced Advantages

Asset Allocation-First Investment Portfolio – Construct the portfolio, then manage risk

With predetermined asset class ratios, investment risk may change with market fluctuations, and leading to a possible mismatch between risk and asset allocation ratios

![]()

With predetermined asset class ratios, investment risk may change with market fluctuations, and leading to a possible mismatch between risk and asset allocation ratios

Risk-based Multi-asset Portfolio - Manage risk, then construct the portfolio

Assess risks before determining asset allocation, allowing for more effective control of portfolio risk and achieving a better balance between risk and return

BU Global Flexi Allocation Fund Characteristics

An investment portfolio that aligns with market conditions

Broadly participate in diverse markets and asset classes through investing in ETFs across different regions and themes*

![]()

Assess risks before determining asset allocation, allowing for more effective control of portfolio risk and achieving a better balance between risk and return

Broadly participate in diverse markets and asset classes through investing in ETFs across different regions and themes*

|

|

1 Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) for November 2024. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return. The directors may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the

shareholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per share.

Important note:

1. BU Global Flexi Allocation Fund ("the Fund") is a sub-fund of BU Investment Series OFC ("the Company"), which is a public open ended fund company ("OFC") (business registration number 72687438) regulated under the laws of Hong Kong, with variable capital and limited liability and segregated liability between sub funds.

2. The Fund invests in emerging markets and may be subject to higher liquidity and volatility risks.

3. The Fund invests in debts or fixed income securities are exposed to interest rates, credit/counterparty, downgrading, volatility and liquidity, valuation and sovereign debt and credit rating risks which may adversely affect the price of the debt securities.

4. The Fund is subject to equity markets risk such as changes in investment sentiment, political, economic conditions and issuer specific factors which may adversely affect the fund value.

5. The Fund may invest in below investment grade and non- rated debt securities, which are subject to greater volatility and liquidity risks than higher rated securities.

6. The directors may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the shareholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per share.

7. In terms of currency hedged class shares, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class shares may result in a decrease in return and/or loss of capital for shareholders. Over hedged or under hedged positions may arise and there can be no assurance that the currency hedged class shares will be hedged at all times or that the manager will be successful in employing the hedge.

8. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors’ base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors’ investments.

9. The Fund may acquire financial derivative instruments for hedging and investment purposes. Given the leverage effect embedded in financial derivative instruments, the Fund may be exposed to significant losses.

10. Investors should not make an investment decision based solely on this material.

^^ If such day is not a business day, the record date will be the immediately preceding business day.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the prospectus of the Fund. Investors should also read the prospectus of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund.

Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The Fund has been authorised by the Securities and Futures Commission ("SFC") in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

‡ Source: Union Investment, as of September 30, 2024. BEA Union Investment is an independently operated investment management company established as a joint venture between The Bank of East Asia and Germany's Union Investment. The company adheres to relevant regulatory requirements to implement business separation between the company and its shareholders.

† The Fund achieving awards from The Asset, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com and Lipper.

# The asset classes mentioned are represented by the following indices: US Equities - S&P 500 Index; European Equities - MSCI Europe Index; Japanese Equities

-Tokyo Stock Price Index (TOPIX);Asia Pacific (Ex Japan) Equities: MSCI AC Asia Pacific ex Japan Index; China/Hong Kong, China Equities - Hang Seng Index;

China A-Shares - MSCI China A Onshore Index; US Treasury - ICE BofA US Treasury Index (10+ years); US IG bonds: ICE BofA US Corporate Index; US HY bonds

- ICE BofA US High Yield Index; Asian IG bonds: ICE BofA Asian Dollar Investment Grade Corporate Index; Asian HY Bonds: ICE BofA Asian Dollar High Yield

Corporate Index; Oil - Brent Crude Oil Futures; Gold - Gold USD; Base Metals - Bloomberg Industrial Metals Subindex Total Return

|

Main Distributors (In no particular order): |