|

|

|

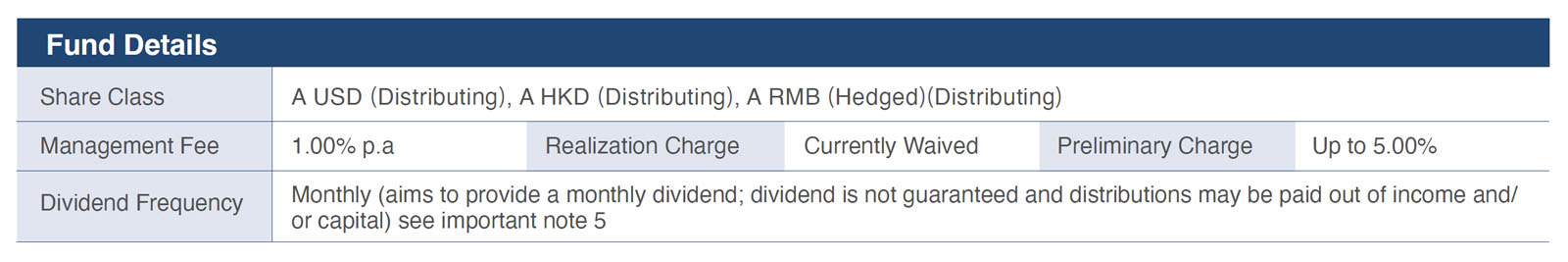

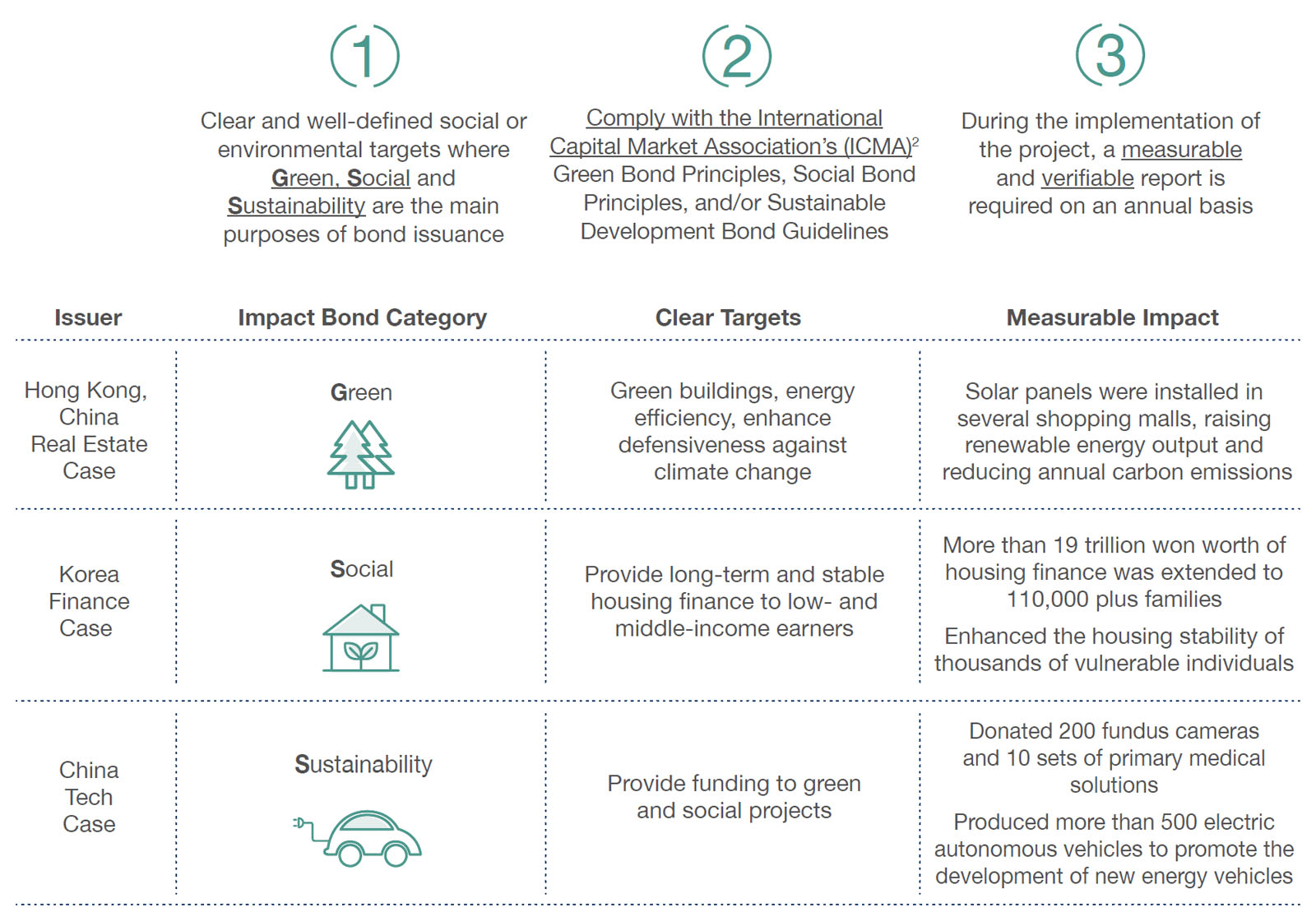

"Impact Investing" and "Impact Bonds" : What are they?

"Impact Investing" is a two-in-one investment solution that brings together the prospects of investment returns and social/environmental improvements. Adopting United Nations' 17 Sustainable Development Goals (SDGs)1 as project principles, impact investing aims to generate measurable social and environmental benefits through designated projects. Impact investing spans an array of asset classes. When it comes to bonds, it is known as "Impact Bonds".

The three attributes of "Impact Bonds"

How does "Impact Bonds" generate a return?

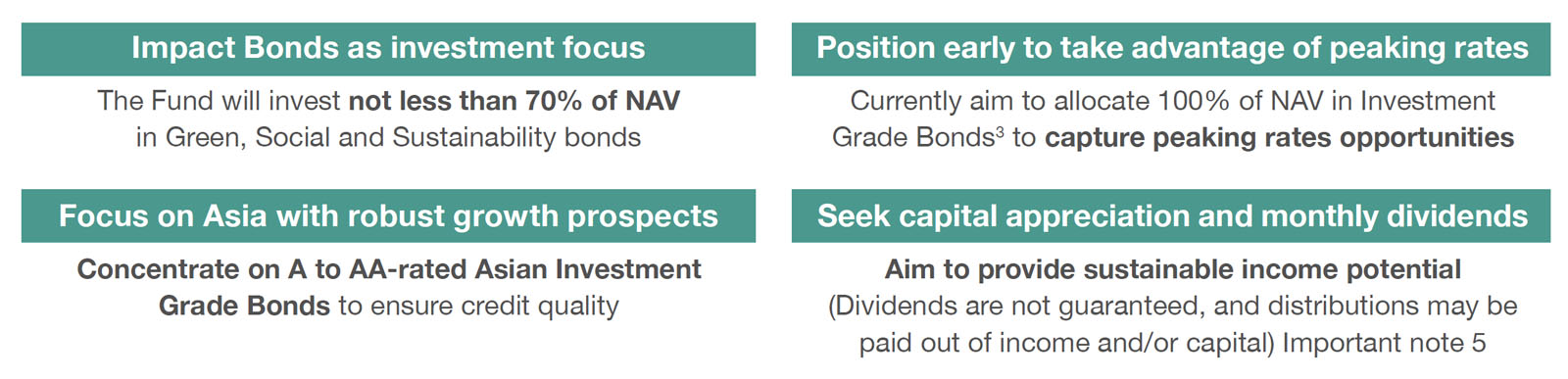

Similar to other bond investments, its returns come from the bond's regular coupon payments and capital gains resulted from bond trading.Features of BU Asia Impact Bond Fund

The Fund primarily seeks to invest in Investment Grade Impact Bonds, providing investors access to innovative bond investing while locking in the prospects of Asian Investment Grade Bonds, bringing the best of both worlds together.

The allure of BU Asia Impact Bond Fund

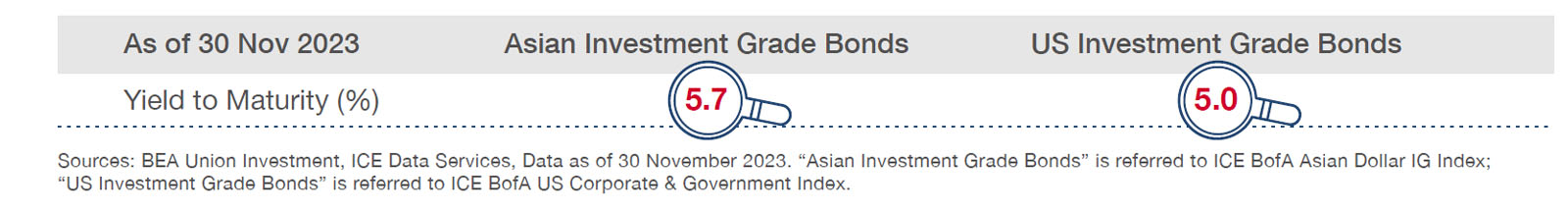

Asian Investment Grade Bond yields appealing; investment-worthy|

|

Asian Investment Grade Bonds have higher yield to maturity than their US counterparts |

|

|

Meanwhile, the 5-year risk-adjusted return (Sharpe ratio4) of Asian Investment Grade Bonds outperforms European and US peers, contributing to potential portfolio return enhancement and volatility reduction. |

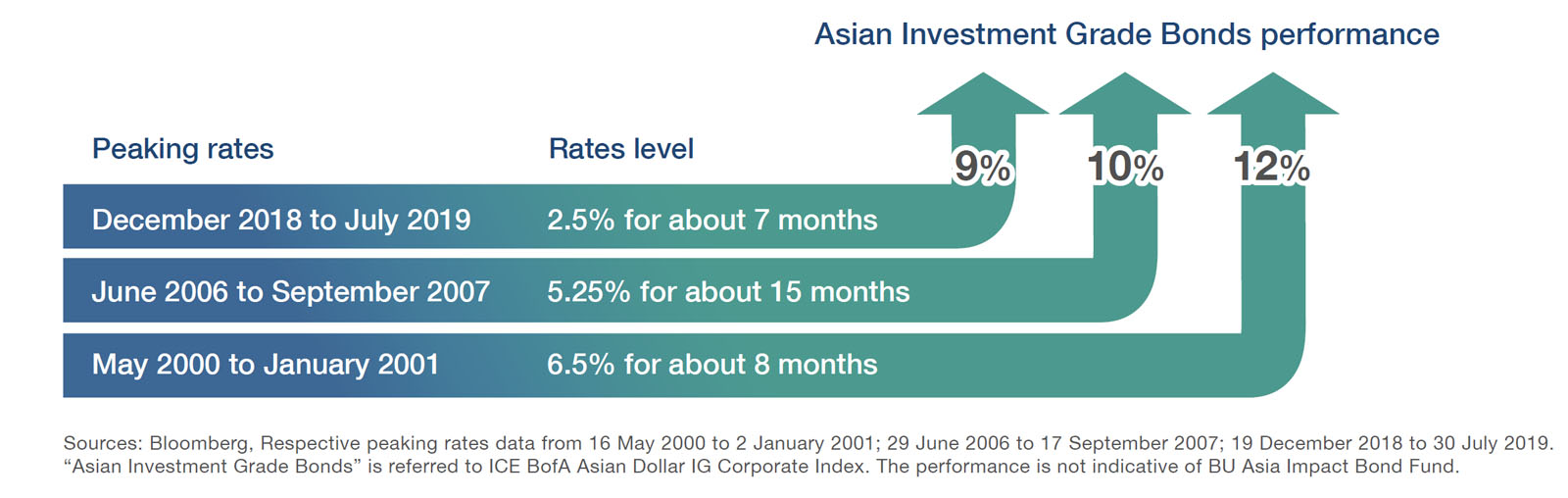

Position early to capture opportunities arising from peaking rates

|

|

Looking back at previous cycles, Asian Investment Grade bonds began their uptrend when interest rates trend stayed flat |

|

|

With the US rate hike cycle expected to conclude soon, investors may consider proactively allocating their allocations in advance to lock in the current attractive yield and position themselves to capture the potential bond price appreciation when interest rates drop. |

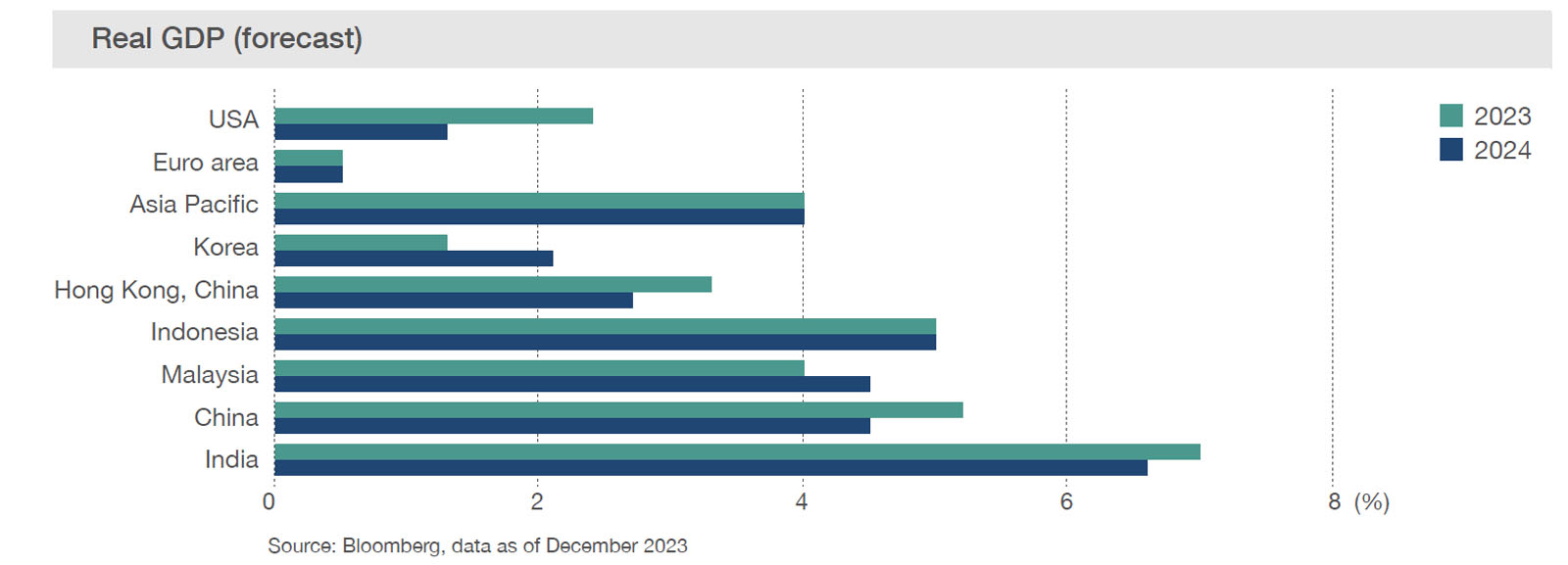

Asia's economic growth momentum remains strong

|

|

With relatively mild inflation pressure, Asia is expected to end its rate hike cycle sooner. South Korea, Indonesia and India have already stopped raising rates, with room to cut rates potentially. Such a move would be favorable to the bond market. |

|

|

Compared to Europe's and the US', Asia's GDP is stronger and enjoys better growth potential. Asia's outlook is expected to remain optimistic. Supported by robust fundamentals, bonds issued by banks and corporates are worth investing. |

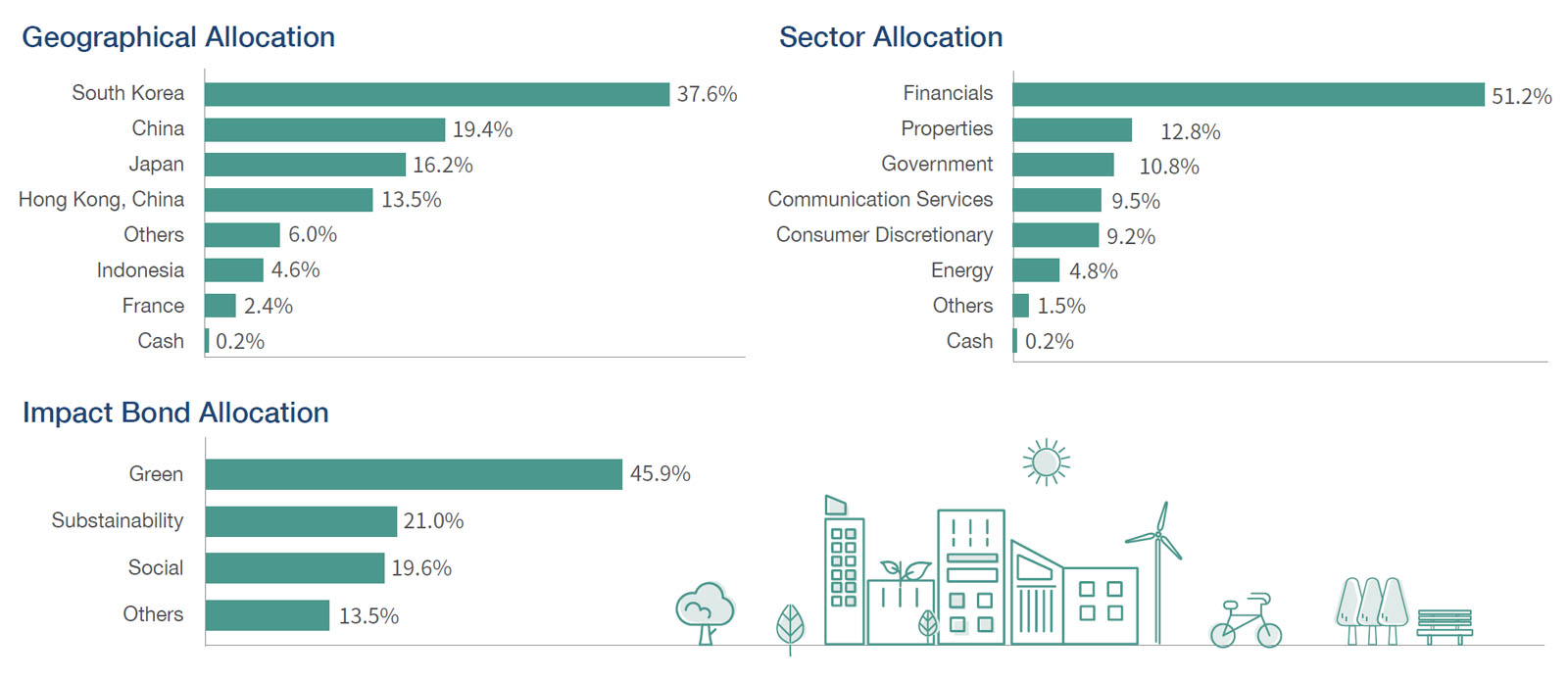

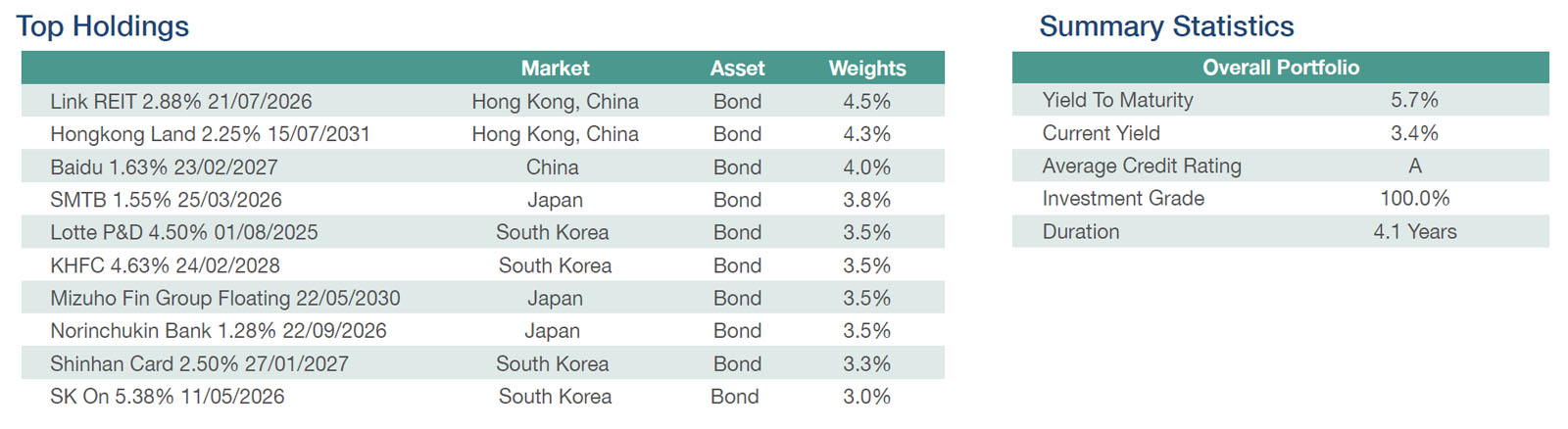

Summary of BU Asia Impact Bond Fund#

Source: Unless otherwise specified, all fund data sources are BEA Union Investment as of 30 November 2023. Month-end asset mixes may total greater than/less than 100% due to rounding. As such the values of the geographical, section and Impact Bond allocation displayed may not total 100%.

#The name of "BU APAC Bond Fund" was changed to "BU Asia Impact Bond Fund" with effect on 23 June 2023. The objective and investment strategy have changed since 23 June 2023.

^^ If the 14th is not a business day in any particular month, the record date will be the immediately preceding business day.

Important note:

1.BU Asia Impact Bond Fund ("the Fund") is a sub-fund of BU Fund Series OFC ("the Company"), which is a Hong Kong public open-ended fund company ("OFC") (the Company was incorporated pursuant to an Instrument of Incorporation filed to the Companies Registry of Hong Kong with registration number OF4), regulated under the laws of Hong Kong with variable capital and limited liability and segregated liability between sub-funds. The Company has been registered with the Securities & Futures Commission (“SFC”) as an OFC and the Company and the Fund have been authorized by the SFC pursuant to section 104 of the Securities and Futures Ordinance. The SFC’s registration or authorization is not a recommendation or endorsement of the Company or the Fund nor does it guarantee the commercial merits of the investors.

2.The Fund seeks medium to long term capital growth and regular income by primarily investing in impact bonds including green, social and sustainability bond instruments in Asia or that are denominated in Asian currencies.

3.The Fund is subject to risk associated with investing in an impact bond strategy, general investment risk, Asian market concentration risk, emerging market risk and currency risk.

4.The Fund invests in debts securities and are subject to risks in interest rates, credit/counterparty, downgrading, volatility and liquidity, valuation, sovereign debt and credit rating risks which may adversely affect the price of the debt securities.

5.The Directors may at their discretion make distribution from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the shareholder's original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share.

6.In terms of currency hedged class shares, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class shares may result in a decrease in return and/or loss of capital for shareholders. Over-hedged or under-hedged positions may arise and there can be no assurance that these currency hedged class shares will be hedged at all times or that the Manager will be successful in employing the hedge.

7.RMB is currently not freely convertible and is subject to foreign exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to exchange risk and there is no guarantee that the value of RMB against the investors' base currencies (for example HKD) will not depreciate. Any depreciation of the RMB may adversely affect the value of investors' investment in the Fund.

8.The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

9.Investors should not make an investment decision based solely on this material.

Issuer: BEA Union Investment Management Limited

1 https://sdgs.un.org/

2 https://www.icmagroup.org/

3 According to the Prospectus, the Sub-Fund will invest at least 70% of its Net Asset Value in investment grade debt securities. Investment grade bonds currently account for 100%.Investment grade bonds currently account for 100% of its Net Asset Value.

4 Source: BEA Union Investment, ICE Data Services, data as of 30 November 2023. The five-year Sharpe ratios for U.S., European and Asian Investment Grade Bonds are -0.13, -0.36 and 0.12 respectively. “US Investment Grade Bonds” is referred to ICE BofA US Corporate & Government Index; “European Investment Grade Bonds” is referred to ICE BofA Euro Broad Market Index; “Asian Investment Grade Bonds” is referred to ICE BofA Asian Dollar Investment Grade Index.

Main Distributors (In no particular order):