|

|

Aim to provide attractive monthly income potential (Dividends are not guaranteed, and distributions may be paid out of income and/or capital) Important note 4 |

|

|

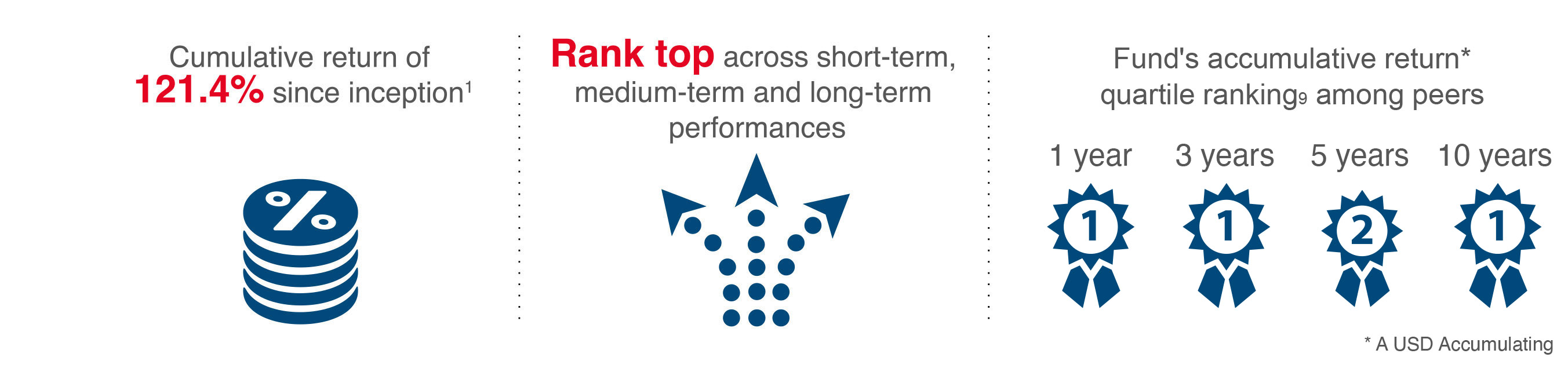

With a proven track record, the fund ranked first quartile among its peers since inception1 |

|

|

A Morningstar 5-star rated fund+, winning 44 fund awards since 20122 |

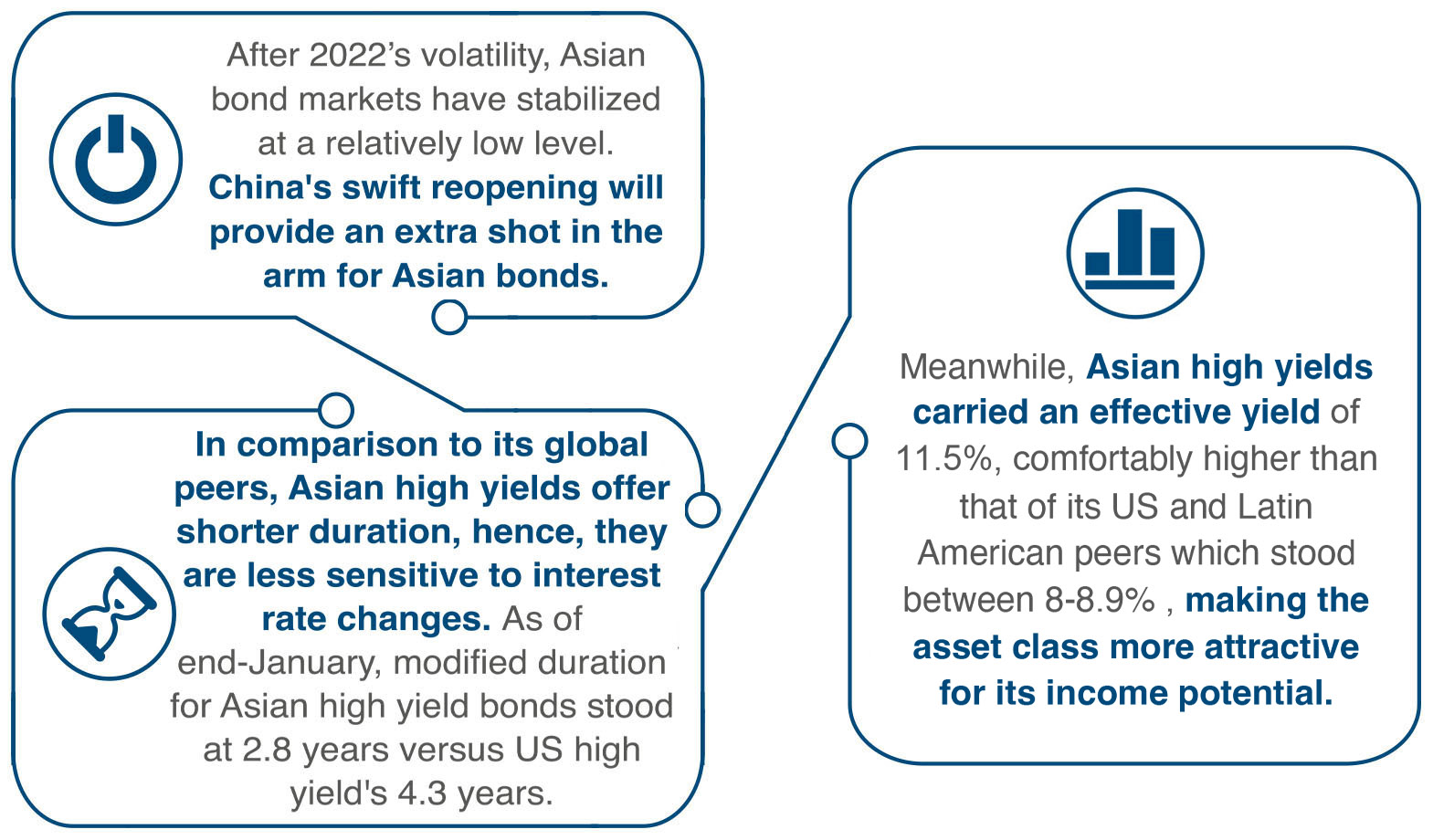

Brace for volatility with Asian bonds

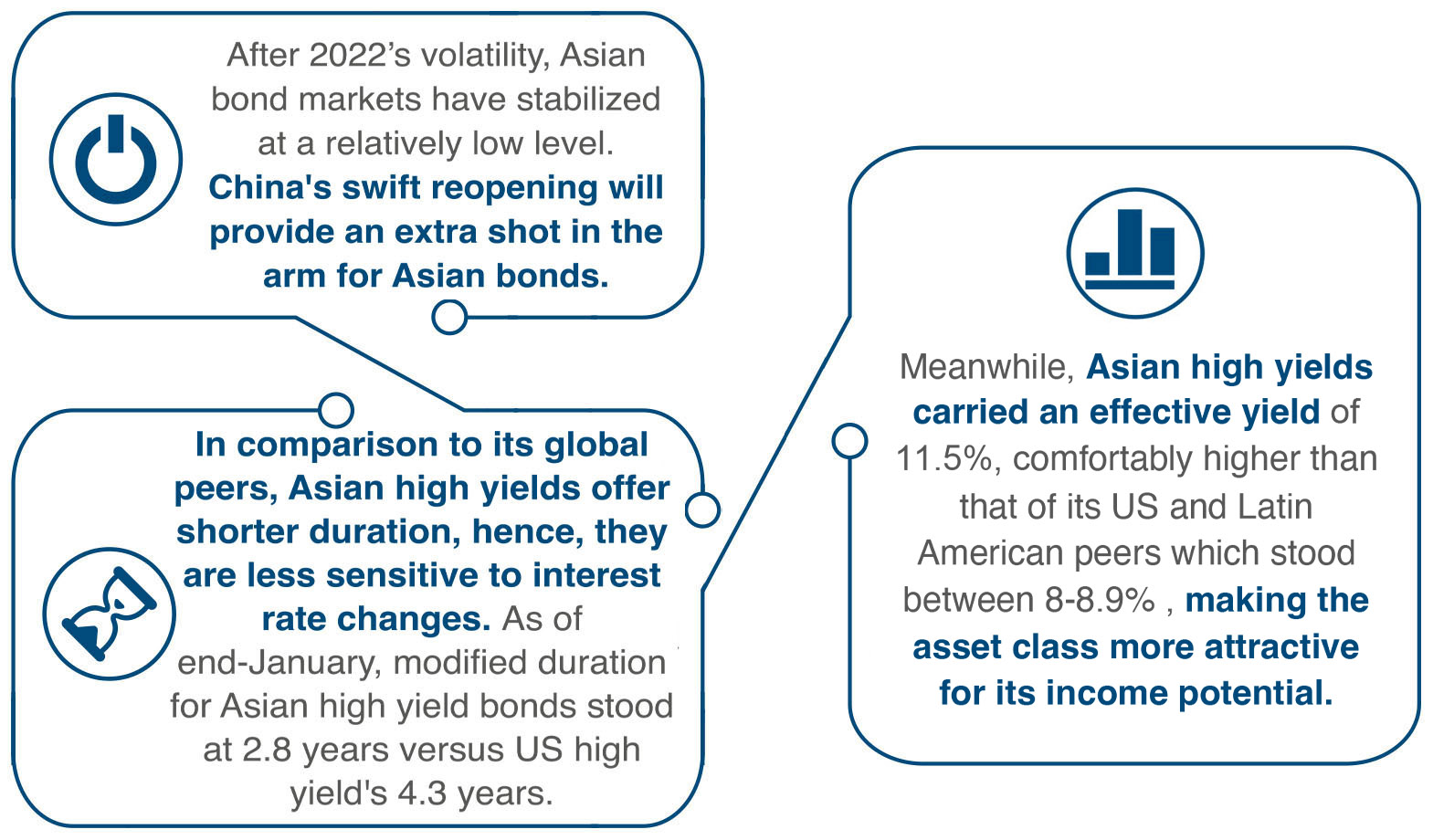

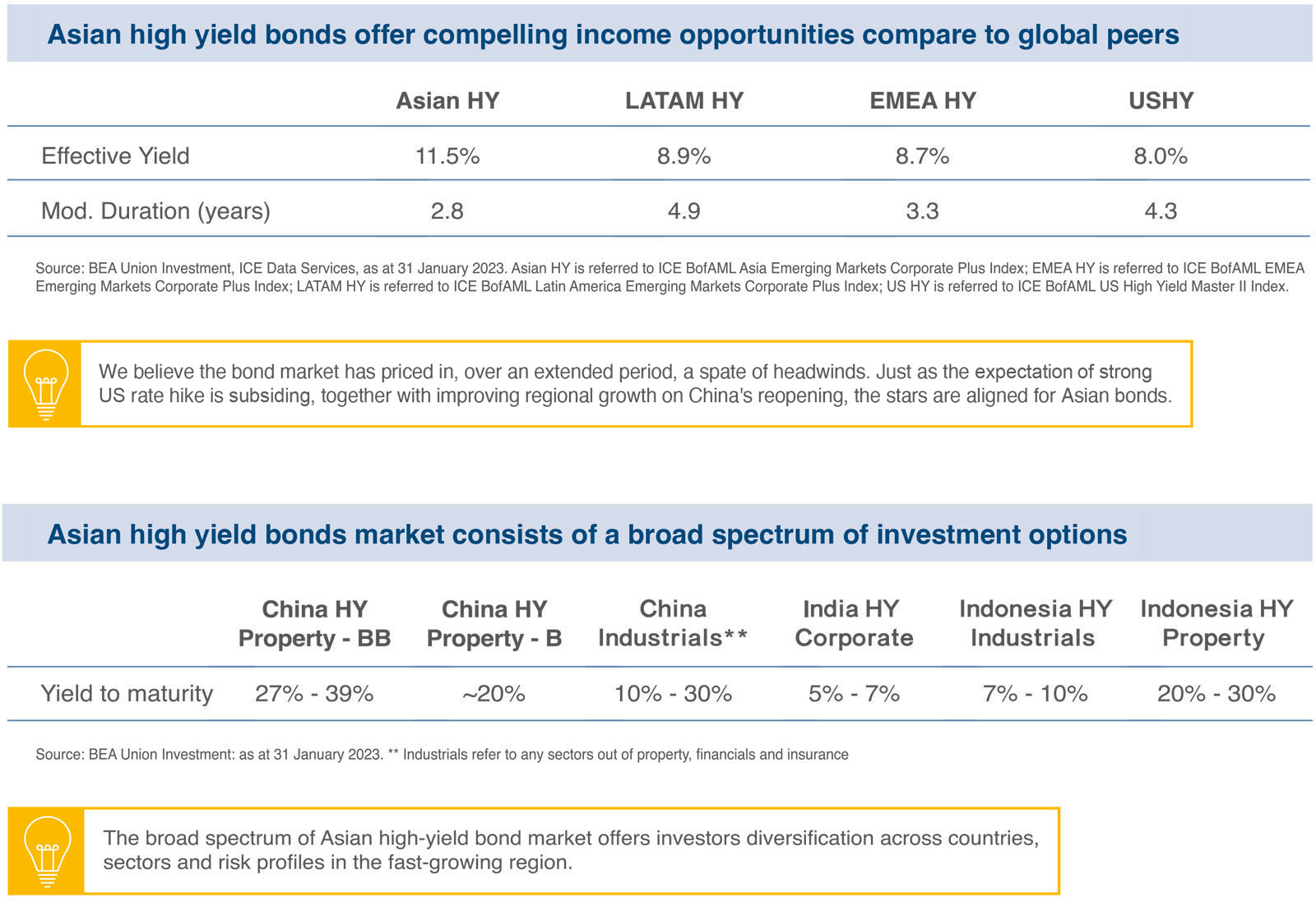

The 2023 outlook remains murky for world. The constant tug of war between inflation and recession means equities will remain volatile, whereas bonds could hold relatively steady, given any further increase in US treasury yields will likely be modest. With market expectation on strong rate hike is on the ebb, investing in fixed income becomes a wise option in the volatile market with a stable stream of income.

China reopening a key source of growth

Major Western countries have qualms that persistently high interest rates will drive economies off the cliff, but Asia’s prospects look more optimistic. The region's economy is expected to expand by 4.7%, faster than last year, when global growth could decelerate in comparison, according to the International Monetary Fund.

China's reopening and accommodative government policies will fuel growth that offset softer demand from weakening global economies. We anticipate a rebound in China's economy is underway which would bode well to regional and global growth.

Asian bonds: All stars aligned for its compelling income potential

BEA Union Investment Asian Bond and Currency Fund "ABC"

Aims to provide monthly dividend to combat inflation

In the midst of a volatile market in 2022, the portfolio maintained an average USD and HK annualized dividend yield of 5.3%3 last year.

In the midst of a volatile market in 2022, the portfolio maintained an average USD and HK annualized dividend yield of 5.3%3 last year.

Stepping into 2023, the fund keeps abreast of market changes, and actively strives for the growth potential of high yield bonds. The USD annualized dividend yield was considerably up-raise to 9%4 in January.

Stepping into 2023, the fund keeps abreast of market changes, and actively strives for the growth potential of high yield bonds. The USD annualized dividend yield was considerably up-raise to 9%4 in January.

(dividends are not guaranteed, and distributions may be paid out of income and/or capital) Important note 4

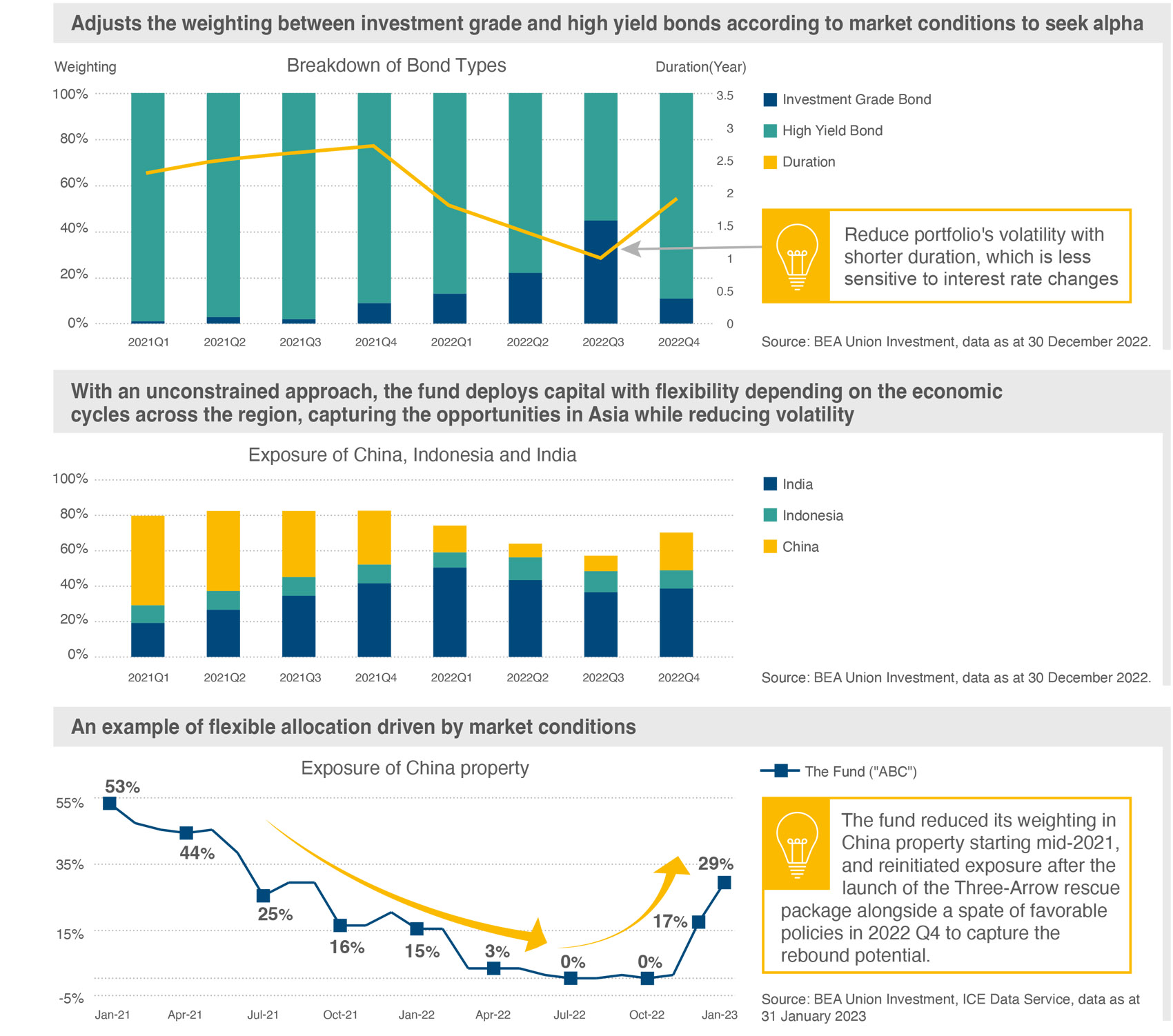

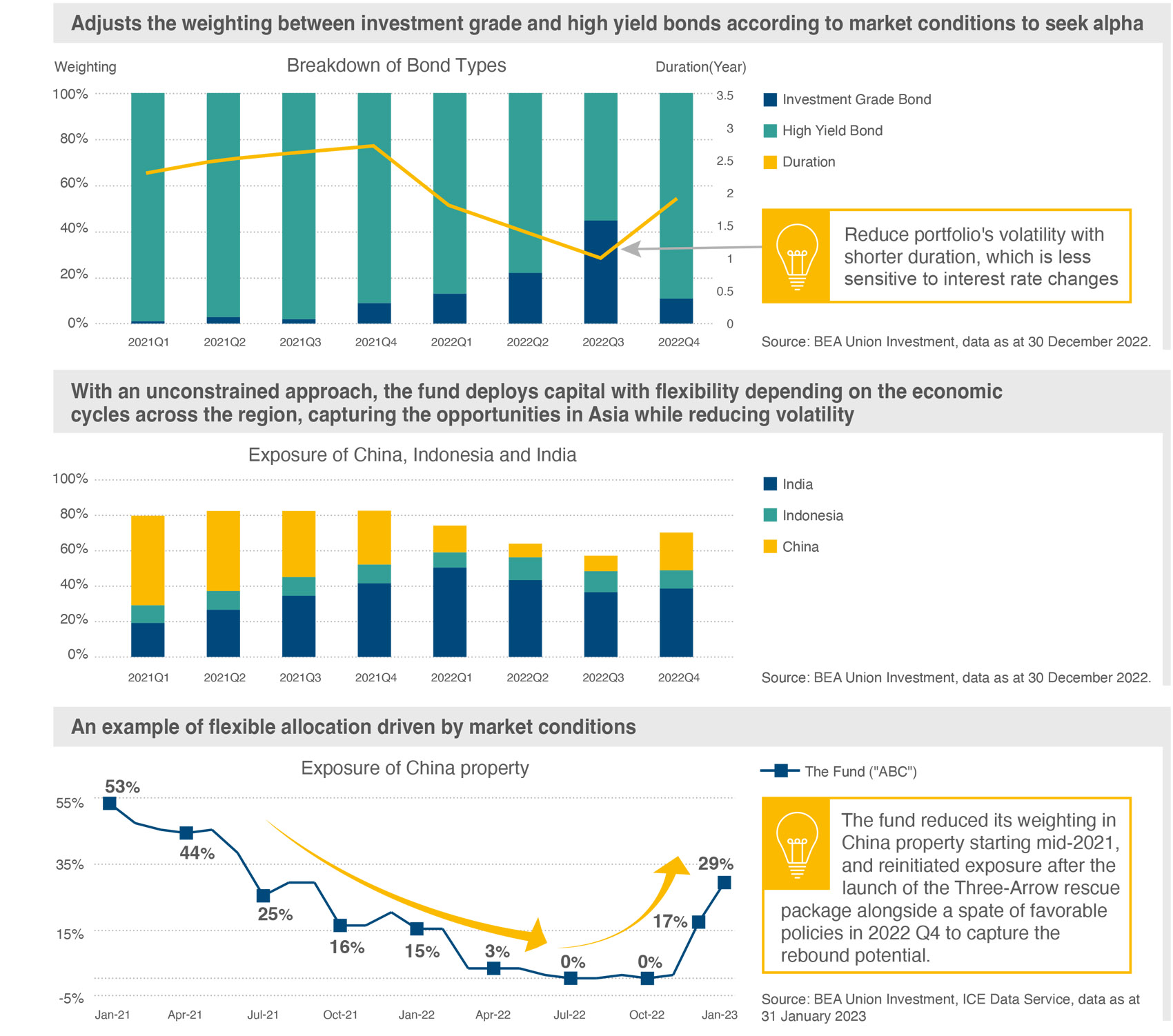

Active management and benchmark agnostic; greater sensitivity to market conditions

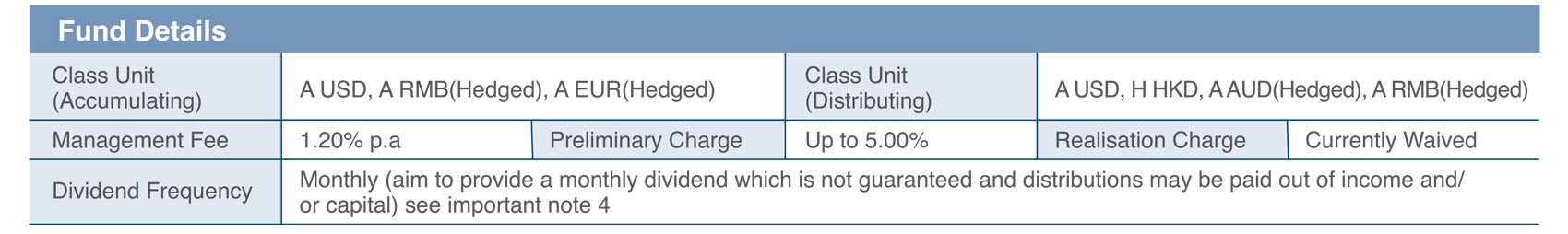

Launched over 14 years, the fund is one of the pioneer fund amongst the Asia high yield bond peers

Launched over 14 years, the fund is one of the pioneer fund amongst the Asia high yield bond peers

Portfolio is diversified more than 80 Asian corporate bonds with overall average credit rating of B+5

Portfolio is diversified more than 80 Asian corporate bonds with overall average credit rating of B+5

The fund currently adopts a short-to-medium duration strategy with a tilt to high-yield bonds

The fund currently adopts a short-to-medium duration strategy with a tilt to high-yield bonds

Leading performances generated by reliable investment strategies

14-year experience in navigating the cycles of different markets; investment capabilities are widely recognized.

Morningstar 5-star rated fund, winning 44 fund awards since 20122

Recent recognitions:

+ ©2023 Morningstar. Data as of 31 January 2023. The rating is for Class A USD (Accumulating). The rating is for reference only and should not be construed as buy and sell recommendation of investment.

1. Source: Morningstar, data as of 31 January 2023. It is for reference only and should not be construed as buy and sell recommendation of investment. The mentioned performance ranking compares against the annualised performance (total return is calculated in USD) of funds authorized by SFC (authorization does not imply recommendation) which are categorized under Asian High Yield Bond Fund category. A USD (Accumulating) launched on 28 Aug 2008. Past performance: 2022: -8.1%; 2021: -8.6%; 2020: -0.4%; 2019: 10.0%; 2018: -2.4%; 2017: 8.2%; YTD (31 January 2023): 6.0%; 1 year: 0.2%; 3 years: -11.5%; 5 years: -5.1%; 10 years: 33.5%. Performance is calculated in Class A USD (Accumulating) of the Fund on a NAV to NAV basis. Gross income is re-invested.

2. The Fund achieving awards from The Asset, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com and Lipper.

3. Source: BEA Union Investment, The mentioned dividend yield is for Class A USD (Distributing) and Class H HKD (Distributing), and is the sum of the monthly annualized dividend yield for the past 12 months, from January 2022 to December 2022 (12 dividends), divided by 12. Annualised dividend yield= (dividend of the current month x 12) / last month end NAV x 100%. Please refer to the dividend notice available on website for dividend composition information and details.

Dividend only applies to distributing classes and is not guaranteed. Past dividend record is not indicative of future dividend likely to be achieved. No dividend will be paid with respect to the Accumulating Classes. Please note that a positive distribution yield does not imply a positive return.

4. Source: BEA Union Investment, The mentioned annualised dividend yield is as of January 2023. The mentioned dividend yield is for Class A USD (Distributing).

Annualised dividend yield= (dividend of the current month x 12) / last month end NAV x 100%. Please refer to the dividend notice available on website for dividend composition information and details. Dividend only applies to distributing classes and is not guaranteed. Past dividend record is not indicative of future dividend likely to be achieved. No dividend will be paid with respect to the Accumulating Classes. Please note that a positive distribution yield does not imply a positive

return.

5. Source: BEA Union Investment and Morningstar Asia, as at 31 January 2023.

6. Source: BENCHMARK, June 2022.

7. Source: BENCHMARK, June 2022.

8. Source: The Asset, 2022 Research for Asian G3 Bonds, performance as at June 2022.

9. Source: Morningstar, data as of 31 January 2023. It is for reference only and should not be construed as buy and sell recommendation of investment. The mentioned performance ranking compares against the funds authorized by SFC (authorization does not imply recommendation) which are categorized under Asian High Yield Bond Fund category.

China reopening a key source of growth

|

|

Major Western countries have qualms that persistently high interest rates will drive economies off the cliff, but Asia’s prospects look more optimistic. The region's economy is expected to expand by 4.7%, faster than last year, when global growth could decelerate in comparison, according to the International Monetary Fund. |

|

|

China's reopening and accommodative government policies will fuel growth that offset softer demand from weakening global economies. We anticipate a rebound in China's economy is underway which would bode well to regional and global growth. |

Asian bonds: All stars aligned for its compelling income potential

BEA Union Investment Asian Bond and Currency Fund "ABC" |

|

Aims to provide monthly dividend to combat inflation

|

|

Active management and benchmark agnostic; greater sensitivity to market conditions

|

Leading performances generated by reliable investment strategies

14-year experience in navigating the cycles of different markets; investment capabilities are widely recognized.

Morningstar 5-star rated fund, winning 44 fund awards since 20122

Morningstar 5-star rated fund, winning 44 fund awards since 20122

Important note:

1. BEA Union Investment Asian Bond and Currency Fund (the "Fund") seeks regular interest income, capital gains and currency appreciation from an actively managed portfolio primarily investing in debt securities denominated in Asian or other currencies and primarily issued by Asian government or corporate entities.

2. The Fund is subject to general investment risk, Asian market concentration risk, emerging market risk and currency risk.

3. The Fund invests in debts securities and is subject to risks in interest rates, credit/counterparty, downgrading, below investment grade and non-rated securities, volatility and liquidity, valuation and sovereign debt and credit rating which may adversely affect the price of the debt securities.

4. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholder's original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

5. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise, and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

6. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk, and there is no guarantee that the value of RMB against the investors' base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect

the value of investors' investments.

7. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risksassociated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

8.Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the Explanatory Memorandum of the Fund. Investors should also read the Explanatory Memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The information contained in this document is based upon information which BEA Union Investment Management Limited considers reliable and is provided on an “as is” basis. This document does not constitute an offer, recommendation or solicitation to buy or sell any securities or financial instruments. The Fund has been authorised by the Securities and Futures Commission (“SFC”) in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and the website have not been reviewed by the SFC in Hong Kong.

1. BEA Union Investment Asian Bond and Currency Fund (the "Fund") seeks regular interest income, capital gains and currency appreciation from an actively managed portfolio primarily investing in debt securities denominated in Asian or other currencies and primarily issued by Asian government or corporate entities.

2. The Fund is subject to general investment risk, Asian market concentration risk, emerging market risk and currency risk.

3. The Fund invests in debts securities and is subject to risks in interest rates, credit/counterparty, downgrading, below investment grade and non-rated securities, volatility and liquidity, valuation and sovereign debt and credit rating which may adversely affect the price of the debt securities.

4. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholder's original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

5. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise, and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

6. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk, and there is no guarantee that the value of RMB against the investors' base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect

the value of investors' investments.

7. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risksassociated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

8.Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the Explanatory Memorandum of the Fund. Investors should also read the Explanatory Memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The information contained in this document is based upon information which BEA Union Investment Management Limited considers reliable and is provided on an “as is” basis. This document does not constitute an offer, recommendation or solicitation to buy or sell any securities or financial instruments. The Fund has been authorised by the Securities and Futures Commission (“SFC”) in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and the website have not been reviewed by the SFC in Hong Kong.